Forma Therapeutics Holdings, Inc.

Published: July 26, 2021 9:00 AM EST

Final Update: Sep 1, 2022

Final note: On the 1st of September, 2022, Forma Therapeutics and Novo Nordisk announced that they had entered into a definitive agreement under which Novo Nordisk will acquire Forma Therapeutics for $20 per share. The deal is expected to close in the fourth quarter, 2022. Hence, there will be no further updates to this page. Congratulations to everyone involved. To continue tracking the global SCD pipeline, find the link in the "Data" tab or click here.

CONTENTS

Early Growth and Finding Form Management Historical Patent Search Ownership Pipeline Etavopivat (FT-4202) A brief overview of SCD PKR activators, MoA PKR activator competition Mitapivat AG-946 Etavopivat data SCD competition FT-7051 AR-v7 splice variant CRPC CBP/p300 Forma’s solution: FT-7051 CBP/p300 competition Related competition Non-core programs Olutasidenib mIDH1 competition FT-8225 Out-licensed programs CC-95775 BI-1701963 Key Intellectual Property Upcoming Milestones ReferencesEarly Growth and Finding Form

History

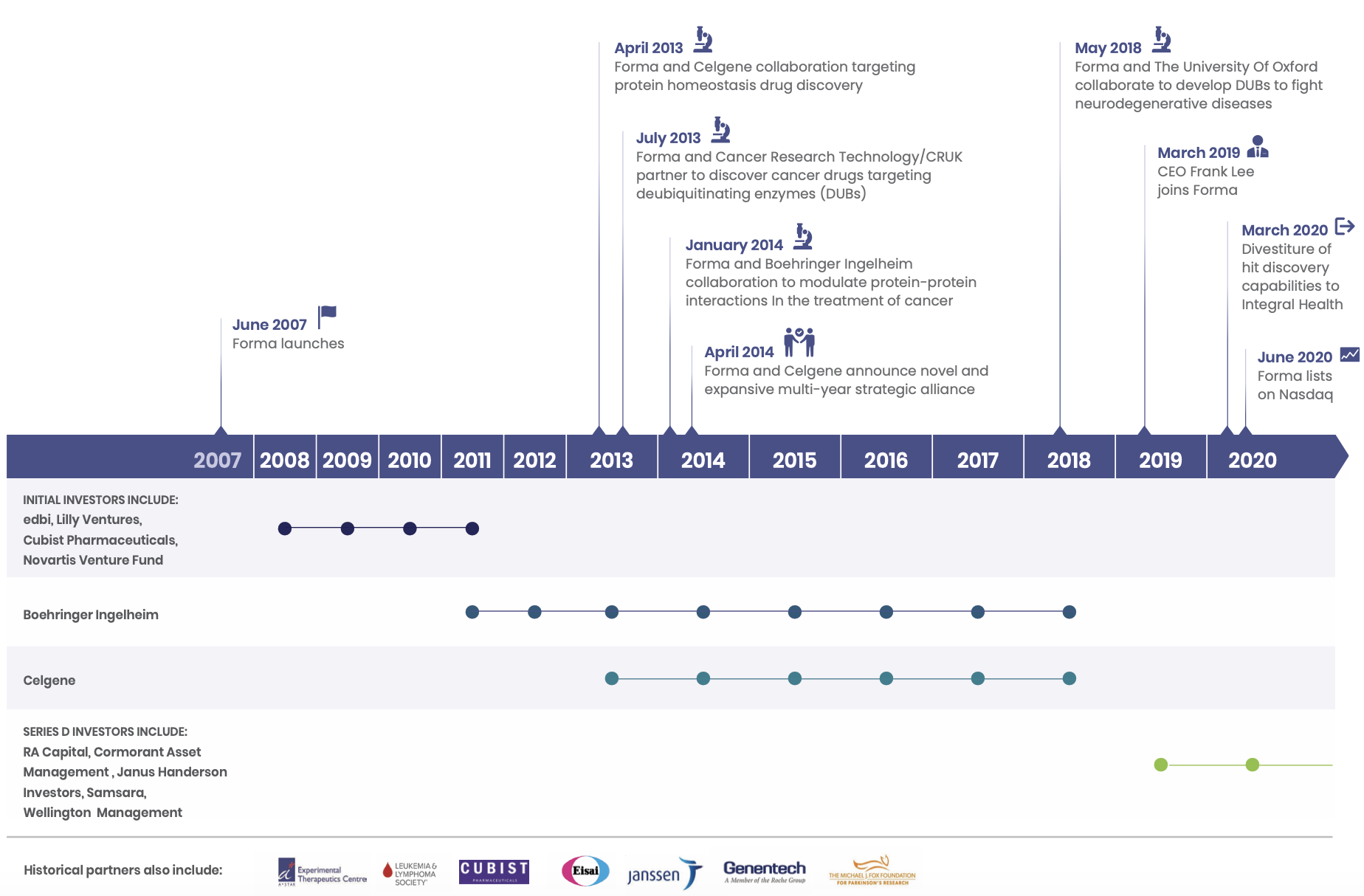

Forma began operations in 2008 in Watertown, MA. The company was founded by popular biotech entrepreneur/investor Alexis Borisy (co-founder of Relay, Blueprint Medicines, Foundation Medicine and Partner at Third Rock Ventures), Nikolai Kley (VP and Head of Research at GPC Biotech & Forma VP, Discovery Biology and Drug Discovery until 2015), Steven Tregay (Forma President and CEO until March 2019), Michael Foley (director of the Broad Institute's chemical biology platform), Stuart Schreiber (co-founder of Broad Institute, Vertex, Ariad, Infinity Pharmaceuticals, H3 Biomedicine and Jnana Therapeutics and Howard Hughes PI), and Todd Golub (Director of Cancer Program at Broad Institute and Howard Hughes PI).

In the early days, the company focused on leveraging their chemistry platform to develop a diversified portfolio of drugs. Founding CEO Steven Tegray was quoted as saying at the beginning of 2009, "We want to avoid being in a position of betting the company on one or two products. We're looking to have a robust pipeline through all the phases, numerous programs, with several through lead optimization at any one time. I think we would like to position Forma as a leading global drug discovery engine, targeted on breakthrough oncology drugs that are first and best in class."

Of the earliest deals struck by Forma was in early 2009 with Cubist Pharmaceuticals: a three-year collaboration to develop antibiotics for drug-resistant bacteria such as MRSA.

I could not find the outcome of this three year collaboration; Cubist was eventually acquired by Merck and by the end of the three years Forma had moved away entirely from this space to focus on oncology. In January 2012, at the expiry of the Cubist collaboration, a new deal was struck with Boehringer Ingelheim. This would be the company's first major deal, with a $65 million upfront payment and up to $750 million in potential pre-commercial milestones. This deal would lead to the development of one of Forma's core out-licensed programs today, BI-1701963, a SOS1:KRAS inhibitor currently in Phase I for KRAS-mutated solid tumors. January 2012 was an active time for Forma. Another collaboration agreement was signed with Janssen to develop drugs to tumor metabolism targets with an option for Janssen to enter into a license agreement. This option would later be exercised in July 2013.

In April 2013, Forma found another partner in Celgene when it announced a 200 M collaboration deal (paid over the course of 4 years) to co-develop and commercialise drug candidates that 'regulate protein homeostasis targets'. The following years would see the majority of funding coming from the agreements with Boehringer and Celgene.

In 2014, Celgene and Forma expanded their relationship with a major agreement to a multi-year strategic alliance that would last up until Bristol Myer Squibb's acquisition of Celgene in early 2019. Forma received an upfront payment of 225 M with an initial collaboration term of three and half years. Celgene had the option to enter into up to two additional successive two-year collaboration terms for additional payments of $375 million. Celgene was also given the option to acquire Forma in the third collaboration term.

One of the drugs coming out of this collaboration is CC-95775 (FT-1101), a pan-BET bromodomain inhibitor Celgene (Bristol Myers Squibb) currently has in Phase 1b. The trial, NCT04089527 began in October 2019 and is due for primary completion in July 2021. The first patient was dosed by Forma on January 12 2016.

Forma and Celgene were also partnered for the development of drugs to NASH, in which Forma discovered FT-4101, an FASN inhibitor. As part of the collaboration, Forma completed a phase I clinical trial after which Celgene would take over. However, Celgene did not pursue its development, although they had the drug listed in their pipeline in 2017. The results of the Phase 1 trial were reported at AASLD The Liver Meeting 2019 in November 2019, and Forma took the drug into Phase 2, but terminated the trial before any data were generated. FT-4101 was likely abandoned in exchange for the second generation FASN inhibitor that Forma is currently developing for NASH as an unencumbered asset - FT-8225.

In January 2019, when BMS announced its intentions to acquire Celgene, Celgene's ties with Forma were severed. This was a major setback for Forma, and in the same month, Forma cut dozens of employees as part of its reorganisation efforts. Forma was then incorporated, and the company took a strategic turn away from discovery R&D and honed in on driving its own pipeline into the clinic. In the same year, the company would raise 100 M in series D financing, led by RA Capital, Cormorant Asset Management, Wellington Management, Samsara BioCapital and others.

The following year in June 2020, Forma completed an IPO, netting proceeds of $293 million for a market capitalization of ~$850 million. The company completed a follow on public offering in December, issuing 6.095 million shares of common stock at a price of 45.25, netting an additional $259 million

Management

The CEO is Frank Lee, who joined in March 2019. He has 25 years of experience in product development and commercial leadership in the biopharma industry. Prior to joining Forma, Frank was SVP, Global Product Strategy and Therapeutic Area Head for the Immunology, Ophthalmology and Infectious Diseases at Genentech. He was VP Sales & Marketing, of the HER2/Breast Cancer and Oral Oncolytics franchises at Genentech, leading commercialisation of Herceptin, Perjeta and Kadcyla, Tarceva, Zelboraf, Erivedge, and Xeloda. Prior to his tenure at Genentech, he had positions at Novartis, Janssen, and Eli Lilly.

SVP and CMO Dr. Patrick Kelly has been at Forma since 2016 and brings more than 20 years of experience to the company. Prior to joining Forma, Patrick was a Senior Medical Director at Takeda Oncology (Dec 2014-Mar 2016), VP Clinical Development at Infinity Pharmaceuticals (Sep 2011-Nov 2014) and VP, Early Development at Pfizer's Oncology Business Unit (2010-2011). At Forma, he was Head of Translational Medicine (2016-2018), then as VP, Clinical Development (2018-2019) and has been SVP and CMO since August 2019.

SVP Research and CSO David Cook joined Forma in April 2020 and brings more than 25 years experience in the biotech industry. Prior to joining Forma, David was CSO at Seres Therapeutics, a microbiome focused company developing probiotic therapeutics for infection, IBD and oncology. He played a key role in strategy and fundraising (bringing in major investments from Nestle during his tenure). Prior to Seres, David was COO for the International AID Vaccine Initiative. He was also the founding CEO at Anza Therapeutics, another microbiome-focused company spun out of Cerus Corporation in 2007. Prior to this, he held positions at Cerus and Eligix, overseeing R&D, manufacturing, clinical and regulatory affairs. He has an undergraduate degree from Harvard and a Ph.D. in chemistry from UC Berkeley.

The Chairman of the Board is Peter Wirth, appointed in Nov 2012. He was former EVP, Legal and Corp Development, Chief Risk Officer and Corporate Secretary at Genzyme. He worked at Genzyme since 1982 and was a senior executive there from 1996-2011 working to take the company from a small start up to its acquisition by Sanofi in 2011 for $20 billion. He replaced co-founder Alex Borisy as Chairman when he stepped down from the Board.

Historical Patent Search

The company has developed drugs to many interesting and somewhat related targets over its history. See below for a summary.

| Dates of Filing | Class |

|---|---|

| 2007-2011 | Raf inhibitors |

| 2014-2018 | BET bromodomain inhibitors |

| 2015-2019 | mt-IDH inhibitors |

| 2016-2018 | USP7, USP1 inhibitors |

| 2016-2018 | HDAC inhibitors |

| 2018-2019 | PKR activators |

| 2018-2020 | FASN Inhibitors |

| 2019-2021 | CBP/p300 inhibitors |

Ownership

As summarised below.

| Name | Shares | % of total shares outstanding |

|---|---|---|

| RA Capital | 9,011,651 | 19.0% |

| FMR | 4,969,969 | 10.5% |

| Cormorant (Bihua Chen) | 4,720,000 | 10.0% |

| Blackrock | 3,289,576 | 6.9% |

| Novartis | 2,991,705 | 6.3% |

| Eli Lilly | 2,404,069 | 5.1% |

| Vanguard | 2,192,856 | 4.6% |

| Baker Bros | 2,024,876 | 4.3% |

| State Street Corp | 1,871,595 | 4.0% |

| Samsara Biocapital | 1,565,529 | 3.3% |

| Logos | 1,410,000 | 3.0% |

| Perceptive Advisors | 1,250,000 | 2.6% |

| TOTAL OF LISTED | 37,701,826 | 79.6% |

Pipeline

The company has two core programs they intend to develop wholly-owned, Etavopivat (FT-4202) and FT-7051.

In addition to these core progams, the company has two assets they are looking to partner - Olutasidenib and FT-8225. They have two outlicensed assets, CC-95775 and BI-1701963, each stemming from their respective collaborations.

| Candidate | Mechanism of Action | Indication | Phase |

|---|---|---|---|

| Etavopivat (FT-4202) | PKR activator | SCD, B-thalassemia | II/III, II |

| FT-7051 | CBP/p300 bromodomain inhibitor | mCRPC (AR resistant, AR-v7 splice variant) | I |

| Olutasidenib | mutant-IDH1 inhibitor | AML, Glioma | IIb, Ib |

| FT-8225 | FASN inhibitor | NASH | IND cleared |

| CC-95775 | BET inhibitor | NHL | I |

| BI-1701963 | SOS1:KRAS inhibitor | Solid tumors | I |

Etavopivat (FT-4202)

The company’s lead candidate is Etavopivat (FT-4202), a PKR (Pyruvate Kinase-R) activator for the treatment of sickle cell disease (SCD). Despite the approval of recent products for the treatment of SCD and SCD sequela, Forma believes that an unmet need in the population remains. They hope to treat SCD patients with a new class of drugs targeting PKR, as a potential foundational disease-modifying therapy to improve RBC health, viability and hemoglobin measures, while also providing clinical benefits such as the reduction of vaso-occlusive crises (VOCs). Etavopivat has Fast Track, Rare Pediatric Disease (RPD) and Orphan Drug Designation (ODD) for SCD from the FDA, and ODD from the EMA. Based on feedback from the FDA and precedence, the company plans to pursue accelerated approval on Hb response as a primary endpoint, while collecting additional data on VOCs to verify clinical benefit and further support approval. A phase II/III trial (HIBISCUS, NCT04624659) was initiated in Q1 of this year, with the first PO analysis planned at 24 weeks (Hb response). If positive, this would allow filing for accelerated approval, with 52-week data focusing in on the rate of VOCs for full approval. The trial will test two doses versus placebo, a low 200 mg vs a high 400 mg dose once daily.

A brief overview of SCD

Sickle cell disease is a group of hemoglobinopathies characterised by the presence of a single base pair mutation in the β-globin gene. The β-globin gene makes up two β-globin subunits of hemoglobin in its quaternary structure. As a result of this altered structure, the conformation of hemoglobin is altered and the resulting 'sickle cell hemoglobin' (HbS) in its deoxygenated forms insoluble polymers. These insoluble polymers result in severe damage to the red blood cell membrane and aggregation of numerous 'sickled cells', causing microvascular obstruction, endothelial immuno-activation, and other deleterious effects.1

SCD is characterised by anemia (sickle cell anemia) and four types of crises: vaso-occlusive (VOC), also known as painful crisis, sequestrative, hemolytic and aplastic. Vaso-occlusion, which is caused by mechanical impedance to blood flow as a result of the sickling of red blood cells can lead to life-threatening complications but is also a main source of pain and debilitation for SCD patients.

There are approximately 100,000 people in the US with SCD (according to the CDC). The EMA estimates 164,000 SCD patients in the EU. The NIH estimates 20 million worldwide afflicted with the disease. Standard of care for decades has been largely underwhelming with chronic transfusion of packed RBCs (given to about 16% of patients) and hydroxyurea (given to about 67% of patients), thought to activate fetal hemoglobin (HbF) production and having some immunomodulatory effects. Stem cell transplantation is reserved for eligible patients and in the most severe of cases. After decades, two new therapies were approved by the FDA in 2019 with promising therapeutic potential, an inhibitory anti-P-selectin monoclonal antibody (crizanlizumab) to reduce the frequency of VOCs, and a small molecule HbS stabiliser that prevents the polymerisation of HbS (voxeletor, under accelerated approval).

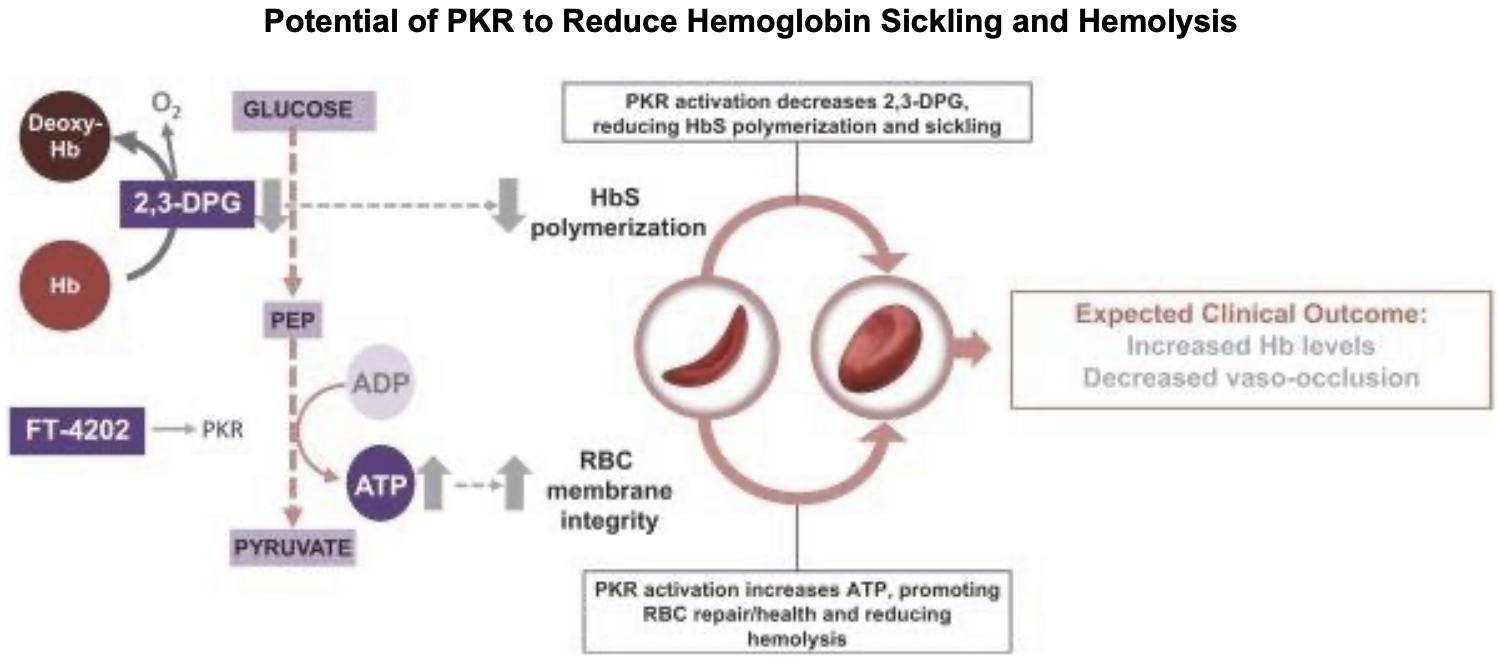

PKR Activators, mechanism of action

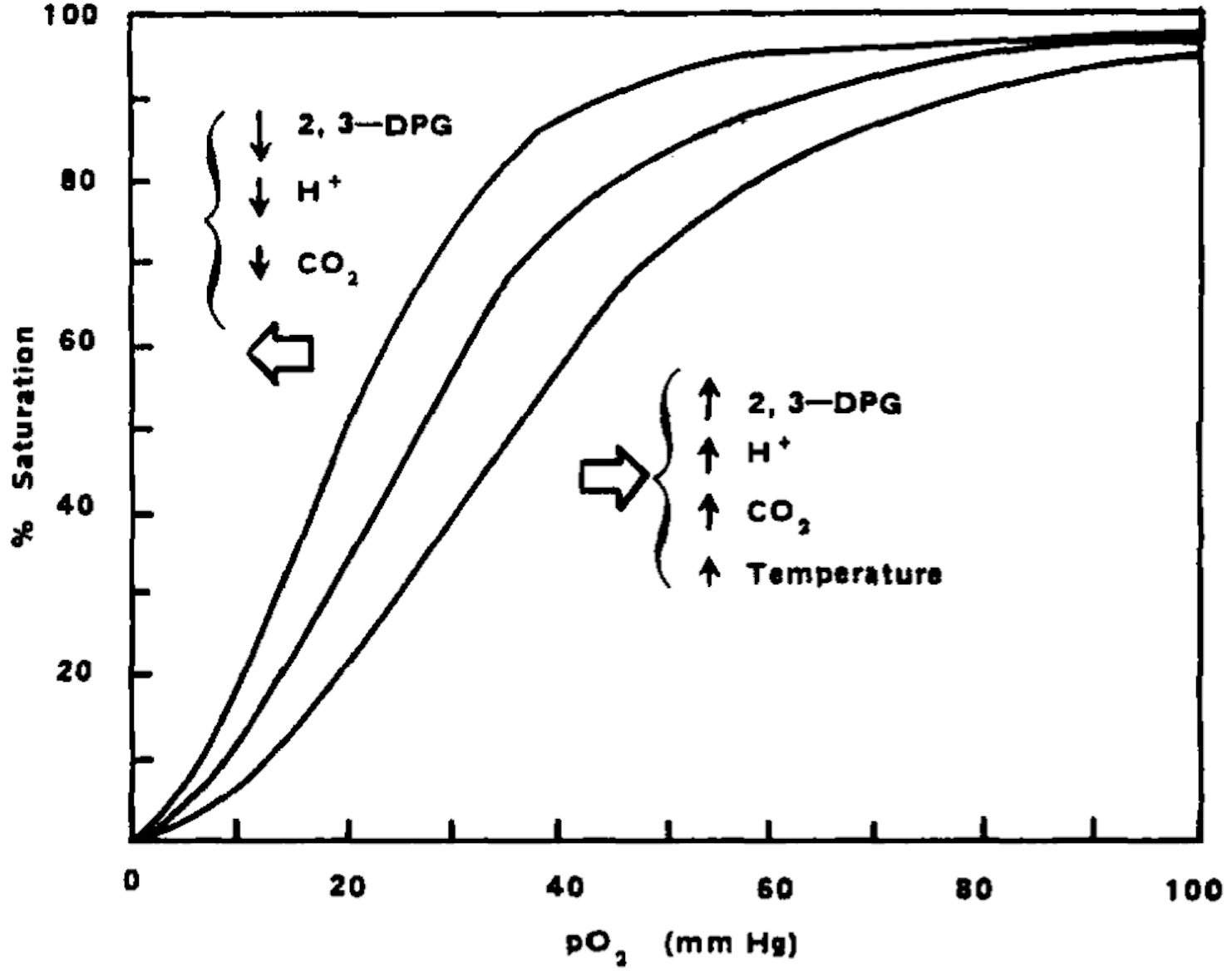

Pyruvate kinase is a key enzyme in the glycolytic metabolic pathway for the production of ATP. There are 4 isoforms of the enzyme, L (expressed in the liver), M1 (muscle and brain tissue), M2 (early fetal tissue and most adult tissues) and R (erythrocytes). The R-isoform is allosterically regulated and has two conformational states, R and T, with high and low respective substrate affinity. When active (R-state), PKR pushes the pathway forward to convert ADP to ATP. 2,3-Diphosphoglycerate (2,3-DPG), which exists in high concentrations in erythrocytes is used in this process. Besides ATP production, glycolysis is an important process for the health of the erythrocyte, as 2,3-DPG significant influences the rate of hemoglobin oxygenation and deoxygenation. In the deoxygenated state, 2,3-DPG binds tightly to the channel interace of hemoglobin, leading to reduced oxygen affinity. Hence, its presence promotes the dissociation of oxygen from hemoglobin and its release into surrounding tissues. 2

Reducing 2,3-DPG (as a natural consequence to the activation of glycolysis) promotes hemoglobin oxygenation by increased affinity of hemoglobin to oxygen (a shift to the right in the oxyhemoglobin dissociation curve). This dynamic also has significant effects on RBC health and viability. When 2,3-DPG is not bound to hemoglobin (in the oxygenated state), the RBC is less deformable and more fragile, while the cell is conversely more deformable and less fragile in the deoxygenated state.3 Hence, the concentration of 2,3-DPG in the cell has modulatory effects on the mechanical properties of the RBC membrane. By reducing 2-3-DPG, the hemoglobin-oxygen complex is stabilised, potentially reducing HbS polymerisation, promoting health and viability of the cell, and reducing the risk of vaso-occlusive crises.

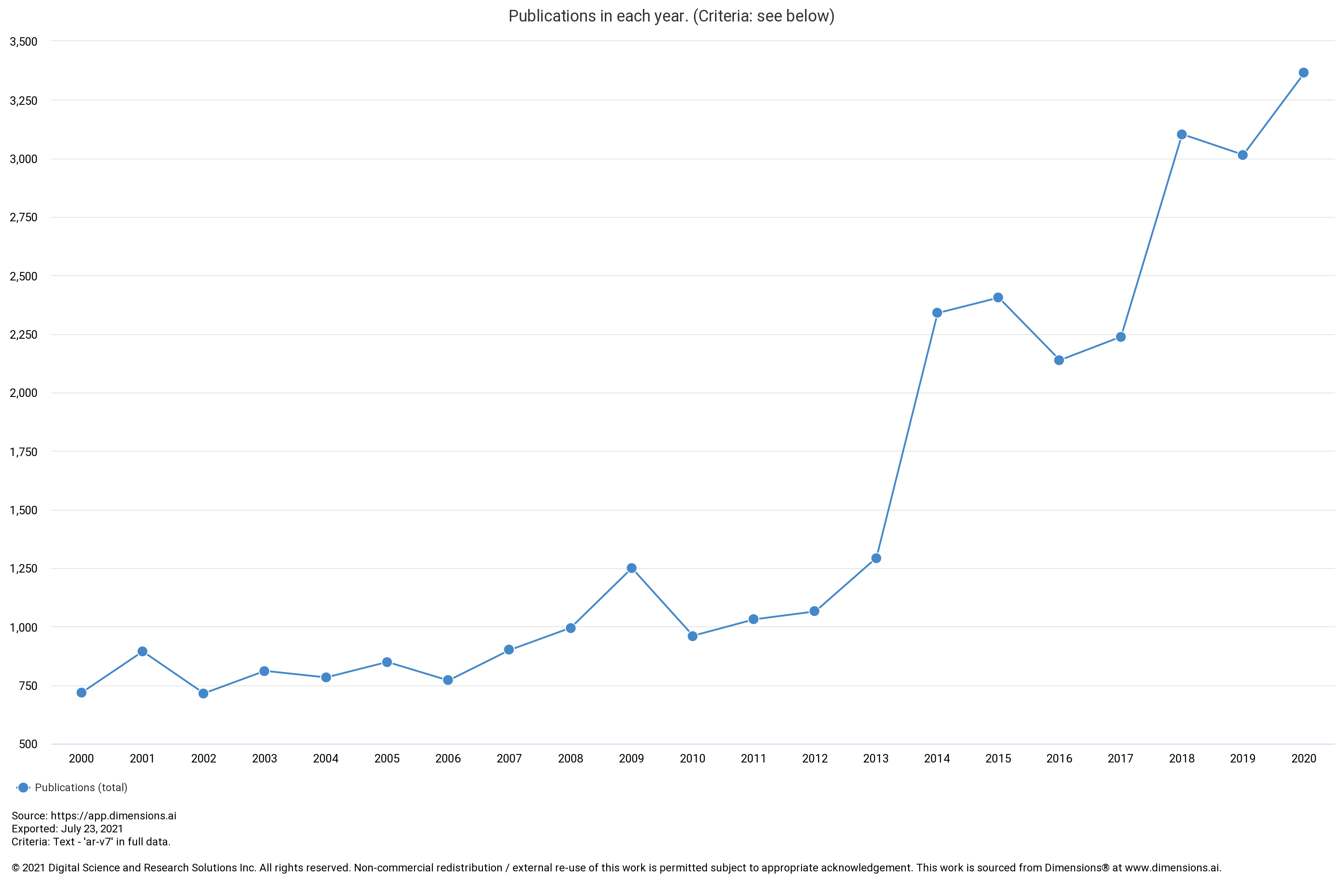

The earliest allosteric modulators of pyruvate kinase were studied in the 90s, with a patent filed in 1998 by researchers at the Virginia Commonwealth University (US patent no. 6,214,879). Work on PKR picked up again in the late 2000s, with a patent filed by the NIH in October 2009 for M2-PKR activators (US patent no. 8,841,305). Shortly therafter, Agios Pharmaceuticals honed in on activators of the R isoform for the treatment of PK-deficiency, thalessemia-associated anemia & SCD. Their first patents in this space were filed in May 2012 (US patents no. 9,181,231 & 9,193,701) and they have been actively pursuing approval with two PKR activators currently in clinical trials.

PKR activator competition

| Company | Candidate | Indication | Phase |

|---|---|---|---|

| Agios | Mitapivat | PK Deficiency, SCD, B-thalassemia | NDA, II, II/III |

| Agios | AG-946 | SCD | I |

Mitapivat

Mitapivat is a first-in-class PKR activator that has demonstrated rapid and sustained Hb increases. In a Phase III trial in patients with PK deficiency not regularly transfused (n=80), 40% of mitapivat-treated patients (n=16) sustained a hemoglobin increase of ≥1.5 g/dL compared to 0 placebo patients. Marked improvements in markers of hemolysis and hematopoietic activity were also seen. There were no AEs that lead to discontinuation. More data can be found here. Phase 2 results were published in an NEJM article here. In June 2021, the company submitted an NDA to the FDA and an MAA to the EMA for the treatment of adults with PK deficiency.

In a phase II trial of patients with non-transfusion-dependent α- and β-Thalassemia, 80% of mitapivat-treated patients (16/20, 5 α-thalassemia and 15 β-) saw hemoglobin increases of ≥1.0 g/dL weeks 4-12.

More relevantly, in a phase I trial of patients with SCD, 7/8 had Hb increases, with 5/8 patients achieving a hemoglobin increase of ≥1.0 g/dL from baseline. A pivotal trial in this indication has been planned and is expected to initiate by year-end 2021.

I recommend this recently published paper for deeper mechanistic data and discussion of Mitapivat.

AG-946

This is the Agios' next-gen R-PKR activator. Its improvements over mitapivat are unclear, but the company initiated a Phase 1 trial this month (NCT04536792) and plans to enroll SCD patients in its MAD cohorts.

Etavopivat, data

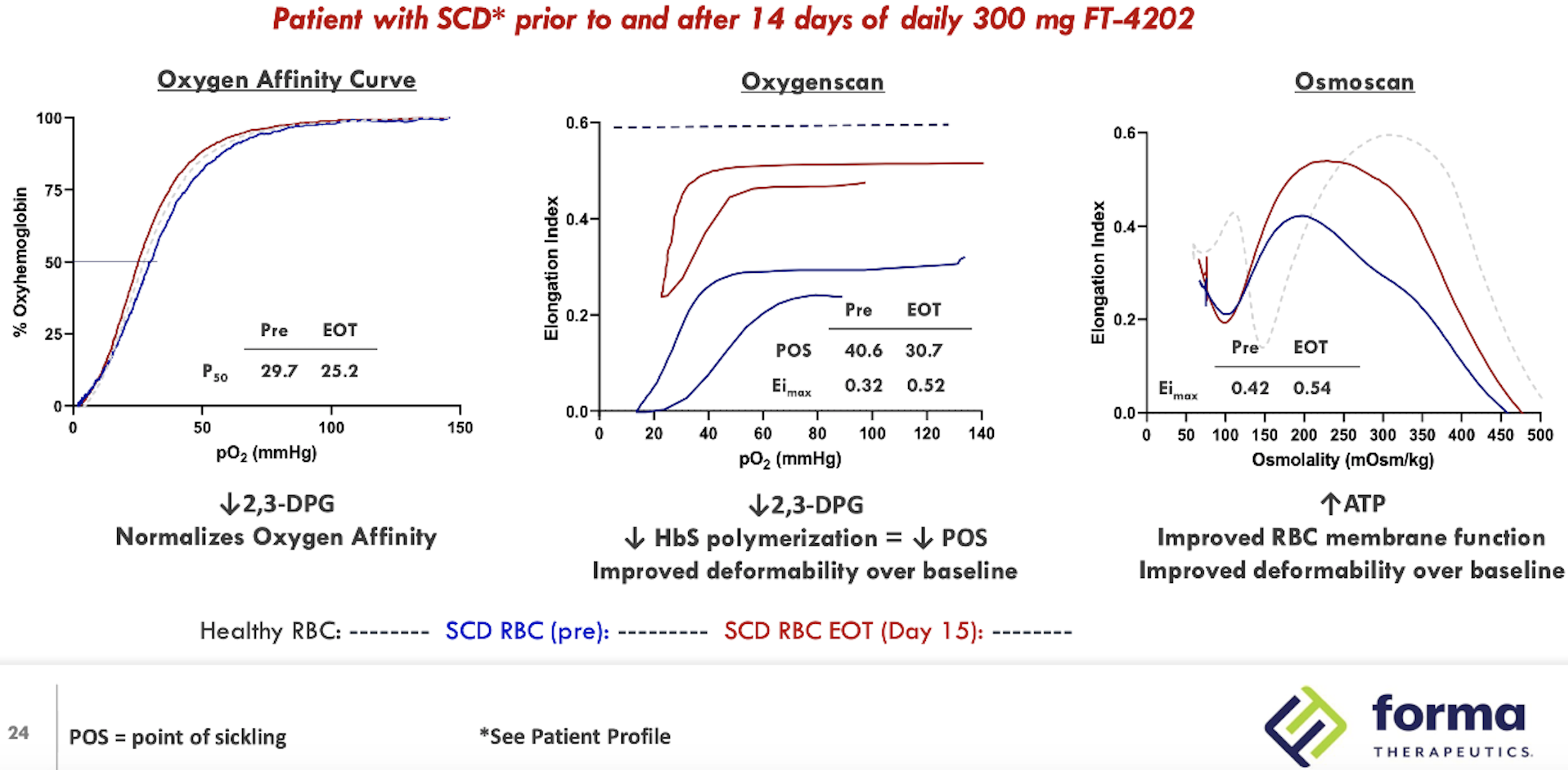

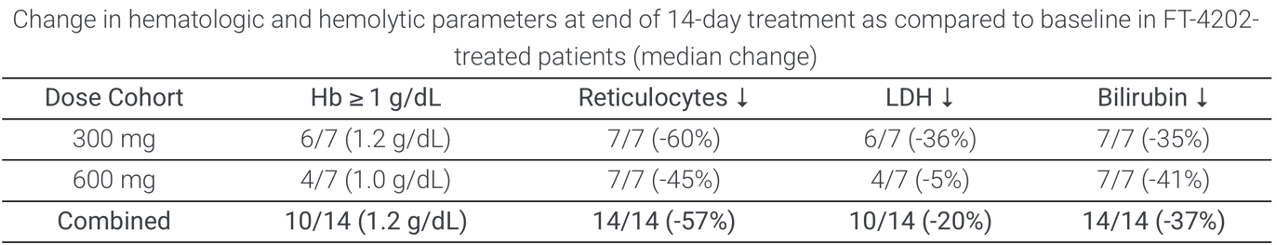

Summarised Phase 1 data for the drug were presented at the 26th European Hematology Association Congress (Abstract #EP1201). Of 15 patients (combined MAD1 and MAD2 groups, 300 and 600 mg QD), 11 had an increase of ≥1.0 mg/dL in hemoglobin (73%). All patients had decreased reticulocytes, 11 had decreased LDH levels and 14 had decreased indirect bilirubin. In the open label extension cohort, (treated at 400 mg QD for at least 2 weeks), 7/8 had an ≥1.0 g/dL increase in Hb. Notably, a durable response up to 12 weeks was observed and improvement in RBC functional health (as measured by oxygenscan and osmoscan) extended beyond the 12 week treatment period. One patient had improved sickle RBC deformability remaining up to 4 weeks after treatment discontinuation.

SCD competition

There are four types of therapies for SCD, curative therapies (genetic), disease modifying agents (such as voxeletor, PKR activators), and symptomatic therapies (such as crizanlizumab for VOC prophylaxis). Gene therapy as a cure for SCD can be life-changing, but its application, durability and safety is still under inspection. For a detailed table of the global pipeline for SCD, check under the Data tab, or click here.

FT-7051

FT-7051 is the company's second core program, a CBP/p300 inhibitor for the treatment of AR-v7 splice variant mCRPC, a subset of mCRPC that expresses a splice variant of the androgen receptor.

AR-v7 splice variant CRPC

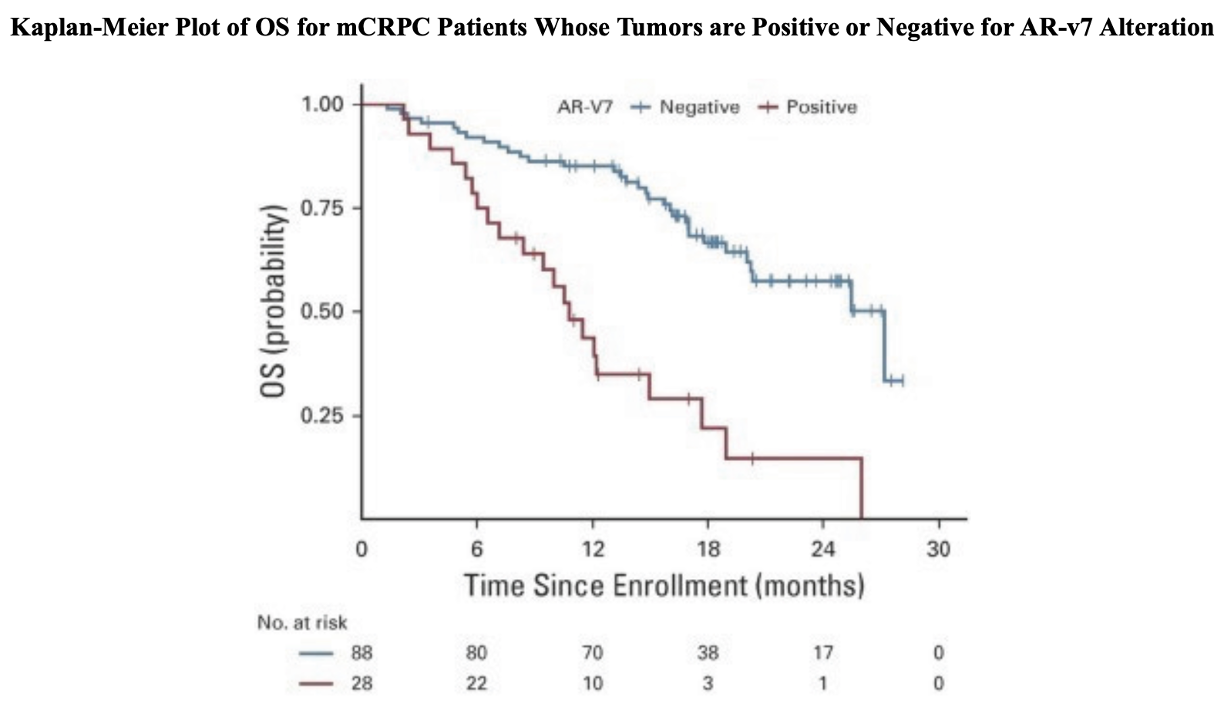

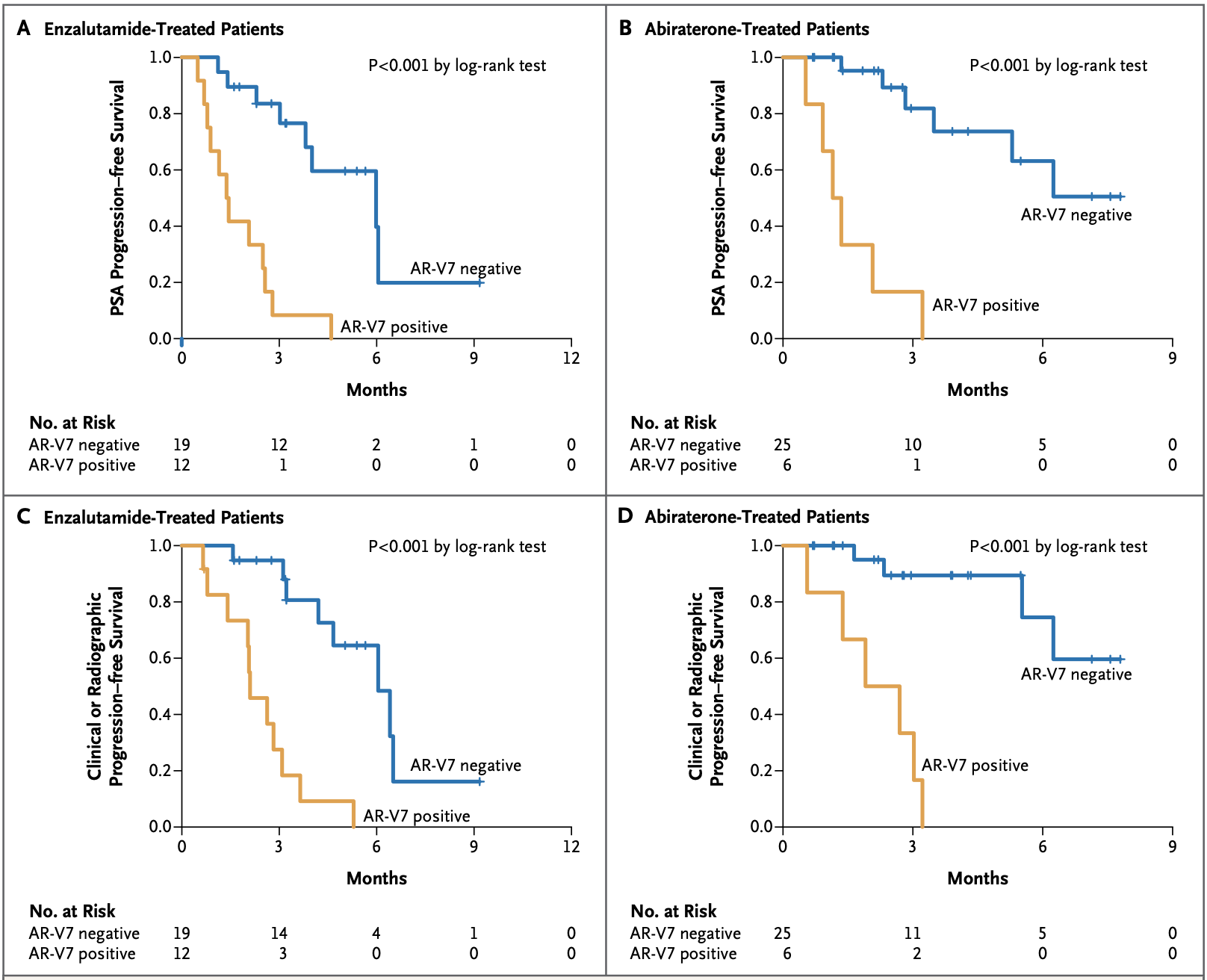

The AR-v7 splice variant as a prognostic factor in CRPC has been getting a lot more attention lately being associated with significantly poorer prognoses. The prevalence of AR-v7 expression is greater in relapsing patients and increases with AR-antagonistic standard of care therapies such as enzalutamide and abiraterone. The splice variant lacks the ligand-binding domain that these therapies target, but remains constitutively active as an oncogenic transcription factor. The result is resistance to existing therapies and growing unmet needs. The splice variant is rarely expressed in primary prostate cancer but can be detected in 75% of cases following androgen deprivation therapy.5 It is also associated with significantly poorer OS, one paper showing a median of 25.2 vs 74.3 months (n=28 AR-v7 positive, n=8 AR-v7 negative, p=0.02).5

Data from the PROPHECY study showed similar results, with median OS at 10.8 vs 27.2 months (n=28 AR-v7 positive, n=88 AR-v7 negative) when using an AR-v7 assay developed at John Hopkins University, and 8.4 vs 25.5 months (n=11 AR-v7 positive, n=94 AR-v7 negative) when using the Epic Sciences circulating tumor cell AR-V7 protein assay.6 There are currently no approved therapies specific for AR-v7 splice variant CRPC.

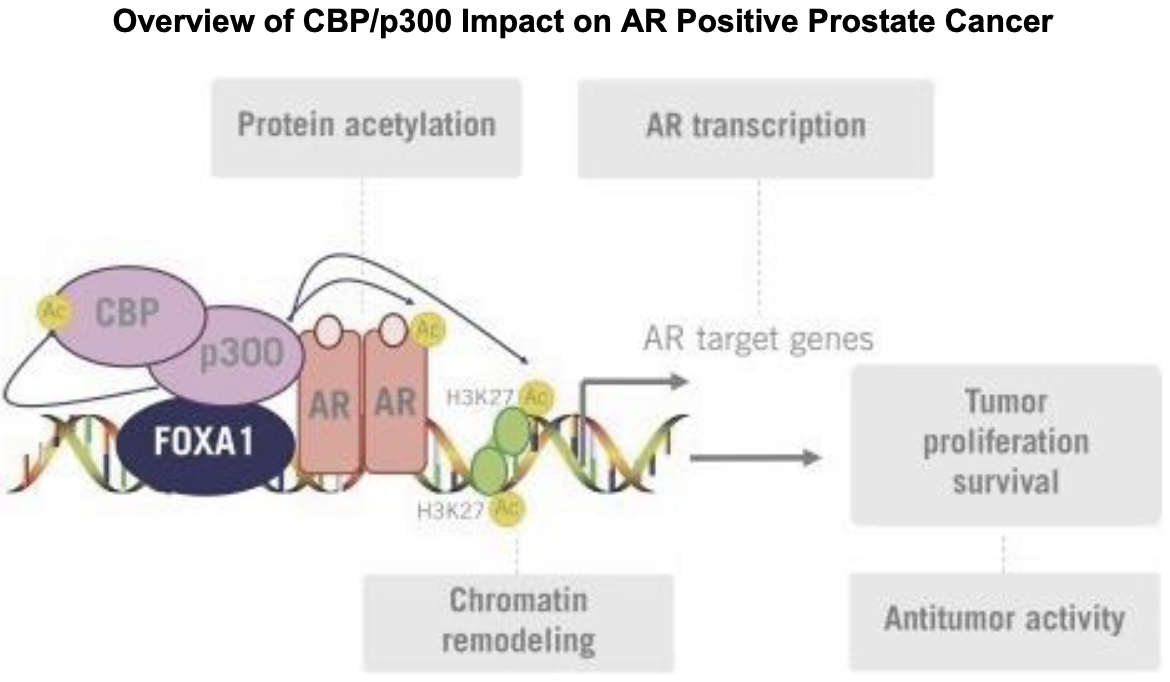

CBP/p300

FT-7051 is a CREBBP (cAMP response element binding protein) that inhibits CREB-mediated gene transcription. Note that CREBBP is synonymous to CBP. CBP and p300 are related proteins sharing several conserved regions8. They share a bromodomain, three cysteine-histidine-rich domains, a KIX domain, and an ADA2 homology domain. CBP/p300 act as scaffold proteins to form transcriptional regulators, modifying chromatin for gene expression. Historically, CBP/p300 inhibitors were initially designed with an interest in treating AML, due to CBP/p300's involvement in hematopoiesis and contribution to the expression of oncogenes that lead to leukemogenesis.9,10 However, CBP/p300 are also co-activators of the androgen receptor (AR). CBP/p300 mRNA expression is significantly associated with AR mRNA expression11, and knockdown of CBP/p300 significantly reduces expression of AR11. Given AR's role in prostate cancer and growing resistance to AR-antagonistic therapies, interest for the use of CBP/p300 inhibitors in this context is growing. For more information on the relevance of targeting CBP/p300 in prostate cancer, see this recent paper. I recommend this review for more information on CBP/p300.

Forma's solution: FT-7051

FT-7051 is an orally administered inhibitor of the bromodomain of CBP/p300. It has an IC50 of less than 1 nM. An IND for FT-7051 was cleared in April 2020 and the first patient in the ongoing Phase 1 study was dosed on Jan 20 2021. Eight sites across the US are recruiting for a target enrollment of 45 patients with progressive mCRPC who have failed at least one anti-androgen therapy. Early safety, PK/PD and preliminary biomarker data is scheduled for release in the second half of this year around ESMO 2021. The complete data set including clinical activity is anticipated to be released at ASCO 2022.

With AR-v7 positivity increasing in patients treated in later lines of therapy and a high association with poorer prognoses, I believe FT-7051 warrants greater attention. The drug has potential to circumvent tumor resistance developed to anti-androgen therapy, serving a large underserved population in the 2L, 3L and 4L+ CRPC context.

CBP/p300 competition

| Company | Candidate | Indication | Phase |

|---|---|---|---|

| CellCentric | CCS1477 | mCRPC, advanced solid tumors | I/IIa |

| Roche/Constellation | GNE-781 | - | Preclin |

| Roche/Constellation | GNE-049 | - | Preclin |

| AbbVie | A-485 | - | Preclin |

| Aurigene Discovery Technologies | AU-18069 | - | R&D |

CellCentric has the most advanced drug in the CBP-p300 inhibitor class with its drug CCS1477, currently in phase 1/2a. They presented pre-clinical data at ASH 2019 showing activity in AML/MM cell lines resistant to lenalidomide, and and was highlighted in this great aforementioned paper.

Roche/Genentech and Constellation Pharmaceuticals have some CBP-p300 inhibitors in preclinical development, GNE-781 and GNE-049. AbbVie is also interested with its own drug, A-485, also in preclinical development.

Related competition

Drugs which target BRD domains (BET and BRD inhibitors) also inhibit CBP/p300 through its bromodomain. Of these, Zenith Epigenetics has ZEN-3694, a pan-BET bromodomain inhibitor going into Phase IIb in combination with enzalutamide in mCRPC. They released PhIb/IIa data in androgen-signaling inhibitor-resistant CRPC in October 2020 here. Patients enrolled had progressive disease with prior resistance to abiraterone and/or enzalutamide. The median radiographic PFS was 9.0 months with curiously longer rPFS associated with lower androgen receptor transcriptional activity. Of 75 patients, 14 experienced Gr3+ toxicities.

GSK has a BET inhibitor, molibresib, with data from a Phase I/II study published at ASCO 2020. The poster can be viewed here. 23 CRPC patients were enrolled in the trial, all with ≥3 prior systemic therapy lines. However, 22/23 had grade 3/4 AEs. 16 had serious AEs with 13 of those treatment-related. Of 18 evaluable patients, 1 had a PR, 5 had SD, 10 had PD. The median PFS was 8.0 months, and the median OS was 9.1 months. Development of the drug has been discontinued.

AbbVie is developing mivebresib (ABBV-075), another pan-BET bromodomain inhibitor. A phase I study was completed in 2019 in which 3 PC patients were enrolled, but the drug was repurposed for myelofibrosis in 2021.

Non-core programs

Olutasidenib

Olutasidenib is the Forma's mutant-IDH1 inhibitor. About 6-10% of AML patients and 70-80% of glioma patients have IDH1 mutations. The company has completed a pivotal phase II trial in r/r mIDH1 AML. The data was presented at ASCO 2021 and can be accessed here. Of 123 evaluable patients, 41 had CR/CRh for a composite complete remission rate of 33% (37 of those being CR, 30%). The median duration of response overall was 11.7 months which is 6 months longer than typical SOC. The median OS was 10.5 months and was not reached in the CR/CRh group. The estimated 18-mo OS was 87%. 20% of patients had Gr3/4 febrile neutropenia, 19% anemia, 16% thrombocytopenia, and 13% neutropenia. IDH1 differentiatian syndrome was observed in 14% of patients, most cases resolving with treatment management but one case fatal.

In glioma, an exploratory phase I trial showed evidence of disease control with 1 partial response and 11 stable disease from 24 evaluable patients. A phase Ib/II trial (NCT03684811) for glioma and other solid tumors is ongoing.

The company is currently preparing an NDA based on its phase II AML data.They are also seeking a partner to commercialise the drug. It is worth noting that Agios recently sold its oncology portfolio (including rights to its approved mIDH1 inhibitor, Tibsovo, and its Phase 1 brain-penetrant mIDH1/2 inhibitor, Vorasidenib, to Servier for an upfront payment of $1.8 billion plus royalties (and a $200 M milestone payment on approval of vorasidenib for its use in grade 2 glioma). TIBSOVO net sales in 2020 were $121 million.

mIDH1 competition

| Company | Candidate | Indication | Phase |

|---|---|---|---|

| Agios | Ivosidenib (Tibsovo) | r/r AML with mIDH1 | Approved July 2018 |

| Daiicho Sankyo | DS-1001 | Glioma | II |

| Bayer | BAY1436032 | AML, solid tumors | I+ |

| Lilly/LOXO | LY3410738 | AML, solid tumors | I |

| Agios | Vorasidenib | Glioma | I |

FT-8225

This is a Fatty Acid Synthase (FASN) inhibitor for the treatment of NASH. FASN is a key enzyme in lipogenesis and can contribute to the inflammatory/fibrotic environment leading to NASH. The company has receieved IND clearance for the drug and is seeking a partner for development. Lots of hard times in this space with many dissappointments would suggest this is a smart choice.

As a target, the only other FASN inhibitor in NASH I could find was a drug from Sagiment Biosciences, TVB-2640 (or ASC40), currently in Phase II. Topline results from 12-week data can be seen here. They showed statistically significant dose-dependent reductions in liver fat at -28.2% in the 50 mg cohort (n=28) versus +4.5% placebo (n=27), p=0.0008. More data can be read here.

Out-licensed programs

CC-95775 - Celgene (Bristol Myers Squibb)

This is a BET-bromodomain inhibitor currently in a Phase Ib open-label study (NCT04089527) for patients with advanced solid tumors and r/r NHL. This was one of the drugs coming out of the Celgene agreement. Primary completion of this trial should have been reached in July 2021, with a potential data release soon. Forma has royalty rights on net sales in the single digit percentages, as well as milestone payments.

BI-1701963 - Boehringer Ingelheim

This is a SOS1:pan-KRAS inhibitor currently in Phase 1 (NCT04111458) for patients with KRAS mutated advanced/metastatic solid tumors as a monotherapy or in combination with the MEK inhibitor trametinib. The trial began in October 2019. As interest in this space grows, more trials are anticipated to begin in 2021, exploring its combination with KRAS G12C inhibitors in KRAS G12C mutant NSCLC and CRC. A poster was presented at AACR 2021 which can be accessed here. Forma has received 50 M so far from this collaboration, and have an additional 126 M conditional milestone payments to collect on BI-1701963 development.

For all competitive drugs in this space, check under the Data tab, or click here.

Key Intellectual Property

As summarised below.

| Asset | Patent type & number | Earliest expiry | Jurisdiction |

|---|---|---|---|

| Etavopivat | COM (U.S. 10,208,052) | Mar 2038 | USA, EU, AU, JPN, SK |

| FT-7051 | COM (U.S. 10,870,648) | July 2039 | US, EU, JPN |

| Olutasidenib | COM (U.S. 9,771,349) | Sep 2035 | US, EU, JPN, CHINA |

| FT-8225 | COM (U.S. 10,875,848) | Oct 2039 | US, EU, INT |

Upcoming milestones

The company plans to present initial phase I safety/tolerability, PK/PD and biomarker data for FT-7051 in the second half of this year (possibly at ESMO). A phase II trial of etavopivat in beta-thalassemia is set to initiate in the second half of the year and a trial in pediatrics SCD is set to potentially begin in 1H22. The company has stated that they plan to submit an NDA for olutasidenib by the end of the year and feel confident they are in a good position to do this with a potential partner.

Disclosure: I am a shareholder of Forma Therapeutics as of the time of the publishing of this article. I may exit from this position at any given time without notice. Data presented in this article have been obtained from third-party publications and sources. I do not guarantee the accuracy of this data and all information presented here should be checked and verified accordingly. Readers of this article should each make their own evaluation and judgement of the mentioned companies and of the relevance and adequacy of the information provided. Readers should make other such investigation as deemed necessary. The article is intended for informational purposes. Investors and potential investors are requested to do additional research before investing in any of the companies mentioned in this article. All investments have risks of loss associated with them. Investing is very risky, highly speculative, and should not be done by anyone who cannot afford to lose the entire value of investment and without prior due diligence. Investors should evaluate the risks associated with each individual company before investing.All forward-looking statements are anticipations subject to risks and uncertainties and actual results can differ materially from those projected.

Additional disclosure: This article contains trademarks, trade names and copyrights of Forma Therapeutics and other companies, which are the property of their respective owners.

Tweet

References

1. Marengo-Rowe A. J. (2006). Structure-function relations of human hemoglobins. Proceedings (Baylor University. Medical Center), 19(3), 239–245. https://doi.org/10.1080/08998280.2006.11928171

2. Van Wijk, R. (2005). The energy-less red blood cell is lost: erythrocyte enzyme abnormalities of glycolysis. Blood, 106(13), 4034–4042. doi:10.1182/blood-2005-04-1622

3. Moriyama, R., Lombardo, C., Workman, R., & Low, P. (1993). Regulation of linkages between the erythrocyte membrane and its skeleton by 2,3-diphosphoglycerate. Journal Of Biological Chemistry, 268(15), 10990-10996. doi: 10.1016/s0021-9258(18)82083-x

4. Juel, R., & Milam, J. O. (1979). 2,3-Diphosphoglycerate: Its Role in Health and Disease. CRC Critical Reviews in Clinical Laboratory Sciences, 10(2), 113–146.doi:10.3109/10408367909147131

5. Sharp, A., Coleman, I., Yuan, W., Sprenger, C., Dolling, D., Rodrigues, D. N., … Plymate, S. R. (2018). Androgen receptor splice variant-7 expression emerges with castration resistance in prostate cancer. Journal of Clinical Investigation, 129(1), 192–208. doi:10.1172/jci122819

6. Armstrong, A. J., Halabi, S., Luo, J., Nanus, D. M., Giannakakou, P., Szmulewitz, R. Z., … George, D. J. (2019). Prospective Multicenter Validation of Androgen Receptor Splice Variant 7 and Hormone Therapy Resistance in High-Risk Castration-Resistant Prostate Cancer: The PROPHECY Study. Journal of Clinical Oncology, JCO.18.01731.doi:10.1200/jco.18.01731

7. Antonarakis, E. S., Lu, C., Wang, H., Luber, B., Nakazawa, M., Roeser, J. C., … Luo, J. (2014). AR-V7 and Resistance to Enzalutamide and Abiraterone in Prostate Cancer. New England Journal of Medicine, 371(11), 1028–1038.doi:10.1056/nejmoa1315815

8. Arany Z, Sellers WR, Livingston DM, Eckner R. E1A-associated p300 and CREB-associated CBP belong to a conserved family of coactivators. Cell. 1994 Jun 17;77(6):799-800. doi: 10.1016/0092-8674(94)90127-9. PMID: 8004670.

9. Dutta, R., Tiu, B., & Sakamoto, K. M. (2016). CBP/p300 acetyltransferase activity in hematologic malignancies. Molecular Genetics and Metabolism, 119(1-2), 37–43.doi:10.1016/j.ymgme.2016.06.013

10. Welti, J., Sharp, A., Brooks, N., Yuan, W., McNair, C., & Chand, S. et al. (2021). Targeting the p300/CBP Axis in Lethal Prostate Cancer. Cancer Discovery, 11(5), 1118-1137. doi: 10.1158/2159-8290.cd-20-0751

11. Giotopoulos, G., Chan, W.-I., Horton, S. J., Ruau, D., Gallipoli, P., Fowler, A., … Huntly, B. J. P. (2015). The epigenetic regulators CBP and p300 facilitate leukemogenesis and represent therapeutic targets in acute myeloid leukemia. Oncogene, 35(3), 279–289. doi:10.1038/onc.2015.92

Have feedback? Tweet or DM me @blackseedbio on X, or contact me here.

If you liked this article and want to get notified when updates are available, consider subscribing (it's free, and you can unsubscribe at any time).

If you would like to donate to support the website, please click here.