Krystal Biotech

Published: July 31, 2023 9:00 AM EST

Thanks to everyone who has supported Blackseed Bio by donating or making a database purchase.

You can now also add to the discussion or share your feedback in the new comment section below, powered by Commento. If you would like to support the website and help keep things running, you can do so on PayPal by clicking here or by clicking the coffee cup on the bottom right corner of the page. You can also support the website by making a purchase here. If you would like to contact me about anything, please click here. Thanks again for your support.

CONTENTS

Background & Management Financing Activity Manufacturing Other Corporate Activity Product & Pipeline HSV-1 vectors Dystrophic Epidermolysis Bullosa (DEB) Vyjuvek (B-VEC) Phase I/II Phase III DEB Market Management of DEB Prevalence & Incidence of DEB Forecasting Vyjuvek Sales Looking through the Krystal Ball Competitive Landscape Potential additional indications for Vyjuvek Pipeline Jeune Aesthetics Potential Risks to Pipeline Valuation ReferencesBackground & Management

| Headquarters: | Pittsburgh, PA |

|---|---|

| Founded: | Dec 2015 |

| Operational: | Apr 2016 |

| IPO: | Sep 2017 |

Krystal Biotech was founded by Krish and Suma Krishnan with a mission to develop gene therapies for rare skin diseases. The company was initially self-funded by the Krishnans when operations began in April 2016.

Krish and Suma have a long-standing professional and personal relationship, having worked together for a substantial portion of their careers. They are well-connected and each have decades of experience in the biotech industry.

Krish's career, in particular, has been closely tied to billionaire investor Randal J. Kirk, founder of Third Security, New River Pharmaceuticals, and former CEO of Intrexon. From 2001 to 2008, Krish served at Third Security as Senior Managing Director, COO, and Director of Business Development & Strategy. He also worked with Kirk at New River, serving as COO from 2004 until its acquisition by Shire in 2007. After an intermittent period, their paths would cross again at Intrexon, where Krish would serve as COO from 2011 to 2016 and play a key role in taking the company public.

Following Krish, Suma would also have a notable career of her own at Intrexon, serving as SVP Regulatory Affairs and SVP Product Development (Head of Therapeutics) from 2012 to 2016. She preceded Krish at New River joining a couple of years earlier than him, serving as VP Product Development from 2002 until its acquisition. Beyond this, Suma has also held senior positions at other companies, including Shire and Pfizer. She began her career at Janssen as a discovery scientist.

The Krishnans' professional journeys also overlapped at Pinnacle Pharmaceuticals from 2009 to 2011, where they continued their collaboration. There, Krish assumed the position of CEO, while Suma took on the role of SVP Product Development.

At Krystal, Krish captains the ship as Chairman & CEO, while Suma fuels the engine as President, Research & Development. Together, they have built a robust team and successfully grown the company from 2 to over 200 employees.

Navigating the ship with them are:

EVP & CCO Andy Orth, since May 2021. He was the former head of the U.S. Region at Alnylam Pharmaceuticals (2018-2021). Prior to that role, Andy was VP of Commercial Practice (2016-2018) at Alnylam. He also brings significant experience from Biogen, where he served as VP Global Commercial Strategy from 2014 to 2015, VP US Commercial Effectiveness and Operations from 2011 to 2014, and Senior Director US Commercial Finance from 2009 to 2011.

SVP Clinical Development, Hubert Chen, since Oct 2021. He held multiple roles at Genentech from 2011-2021, most recently as Principal Medical Director, working on omalizumab as a treatment for chronic spontaneous urticaria. He also worked to advance multiple other programs in Genentech's respiratory and immunology portfolio. Prior to his tenure at Genentech, he was an Assistant Professor in the pulmonary division at UCSF and is board-certified in Pulmonary Medicine, Critical Care Medicine and Internal Medicine. He received his MD from Stanford. Hubert will be a key player in Krystal's respiratory programs.

Working alongside Hubert is SVP Clinical Development, David Chien, since Aug 2022. He was Executive Medical Director at Nektar from 2020 to 2022, leading the bempegaldesleukin program. Prior to Nektar, he held various roles at Amgen from 2016 to 2020, most recently as Global Development Lead, leading the Riabni (rituximab biosimilar) and ABP 959 (eculizumab biosimilar) programs. He also held roles at AbbVie, Takeda and holds an MD from UC Davis.

On the commercial side, John Garcia, SVP U.S. Business Sales and Operations, since Sep 2021. Prior to joining Krystal, he held leadership roles at Alnylam from 2016 to 2021, most recently as VP Global & US Business Operations (where he worked with Krystal CCO Andy Orth). He also held roles leading commercial activity at Alexion as a Senior Director from 2015-2016 and at Biogen from 2011 to 2015.

SVP & General Manager Europe, Laurent Goux, since Sep 2021. Prior to Krystal, he held multiple roles at Galderma from 2002 to 2013 and 2016 to 2021, most recently as Head of Global Strategic Marketing and Market Access. He was also a Regional Director for Central, Eastern Europe and Emerging Markets at Nestle Skin Health from 2013 to 2016.

Ram Kamineni, SVP, CMC and Technical Operations, since July 2022. He has decades of experience, including serving as SVP Global Operations at Jubilant Pharma from 2017 to 2021. Prior to this, he held multiple roles at Mylan from 2009 to 2017, most recently as Head of Global Manufacturing Strategy from 2016-2017.

Stéphane Paquette, VP Business Development, since June 2022. He held multiple BD roles at Appili Therapeutics from 2016 to 2022, most recently as VP Corporate Development from 2021-2022.

Note: This is not a complete list of the company's management.

Financing Activity

Pre-seed and Early Days

Business operations commenced in April 2016 with the Krishnans investing $100,000. They contributed an additional $754,000 in September later that year and $1 million in December ($448,000 through a convertible promissory note).

In June 2017, member of the board of directors Dino Rossi was issued a convertible note amounting to $750,000.

The company raised additional funds in August 2017 with equity issued to Sun Pharma. Sun Pharma purchased $7 million in Preferred Stock, giving them 16.5% ownership of the company. Their purchase price was $7.66 per share. Shortly after this, another member of the board of directors and Managing Director of Alta Bioequities, Dan Janney, purchased $1 million in shares of common stock at the same price of $7.66 per share. Alta Bioequities had previously received convertible notes totaling $500,000 in November 2016 and May 2017.

The company went public just a month after the Sun Pharma transaction, closing an IPO of 3,960,000 (+594,000) shares at $10.00 each for a company valuation of ~$100 million. The Krishnans' ownership of the company at this time would dilute to ~39%. Their aggregate ownership as of May 2023 is ~12%.

Summarised Financing Activity

| Date | Type | Gross proceeds |

|---|---|---|

| Pre-IPO | Issuance of equity securities | $2.4M |

| Aug 2017 | Sun Pharma Series A Preferred | $7M ($7.66/share) |

| Sep 2017 | IPO | $45M ($10/share) |

| Aug 2018 | Private placement (Frazier) | $10M ($16/share) |

| Oct 2018 | Public offering | $69M ($20/share) |

| Jun 2019 | Public offering | $114M ($40/share) |

| May 2020 | Public offering | $125M ($55/share) |

| Feb 2021 | Public offering | $144M ($65/share) |

| Dec 2021 | Public offering | $215M ($75/share) |

| May 2023 | Private placement (Avoro, Redmile) | $160M ($92.5/share) |

A summary of what Krystal has done with this money

- Completed IND-enabling studies, Phase I/II (n=12) and Phase III (n=31) clinical trials for KB-103/B-VEC

- Filed and received regulatory approval from the FDA for their first product

- Set up two cGMP facilities (4,500 and 155,000 sq ft)

- Built a fully-integrated biotech company with 210+ full-time employees

- Sponsored multiple other Phase I/II trials to develop a pipeline of HSV-1 vector gene therapies

Note. This is not an exhaustive list.

Manufacturing

The company has two cGMP facilities located in Pittsburgh; Ancoris (4,500 sq ft), completed in January 2019 to supply commercial product of B-VEC (Vyjuvek), and Astra (155,000 sq ft), completed in the first half of 2023. Construction of the Astra facility was initially anticipated for completion in 2020 (2019 forecast), but the timeframe was pushed back a couple of times.

The company is currently using Ancoris (which has global capacity) to manufacture their product, Vyjuvek. Management has indicated that they are planning to shift commercial production to the Astra facility over the next 24 months. Astra will also handle the company's pipeline candidates. The first GMP run at Astra took place in the first half of 2023.

Other Corporate Activity

In March 2021, Krystal Biotech launched Jeune (inc. Apr 2019), a wholly-owned subsidiary to manage the company's aesthetics-related products. The lead program there is KB-301, an HSV-1 vector for lateral canthal lines at rest, discussed later in this report.

Dr. Bhushan Hardas was appointed President of the subsidiary at the time of launch. He stepped down from the position in September 2022 (according to his LinkedIn).

Product & Pipeline

The company is building out a pipeline of candidates with a modified replication-defective HSV-1 vector delivered in different formulations. The following is a summary:

| Product | Gene | Indication | Approval | Route |

|---|---|---|---|---|

| Vyjuvek (B-VEC) | COL7A1 | Treatment of wounds in patients aged ≥6 months with DEB and mutation(s) in the COL7A1 gene | May 2023 | Topical |

| Candidate | Gene | Indication | Phase | Route |

|---|---|---|---|---|

| KB105 | TGM1 | TGM1-deficient ARCI | II | Topical |

| B-VEC | COL7A1 | Ocular complications of DEB | I/II | Instillation |

| KB301 | COL3A1 | Aesthetic skin conditions | I | Intradermal |

| KB407 | CFTR | Cystic fibrosis | I | Nebulized |

| KB408 | SERPINA1 | Alpha-1 antitrypsin deficiency (AATD) | IND | Nebulized |

| KB707 | IL12A & IL2 | Solid tumors | IND | Injection & Nebulized |

| KB104 | SPINK5 | Netherton syndrome | IND | Topical gel |

A little about HSV-1 vectors

Herpes simplex virus 1 (HSV-1) is an enveloped herpesvirus with a linear dsDNA genome. The virus exhibits significant tropism for oral epithelial cells and neurons, but can infect various cell types. Its genome encodes over 80 proteins, many of which play a role in dampening the host immune response. It is capable of establishing lifelong latency in sensory neurons; its genome persisting in an episomal form in the nucleus. In this state, it undergoes limited gene expression with negligible disruption to host-cell metabolism, allowing it to remain hidden and dormant for extended periods of time.Since the 1990s, researchers have been exploring the virus as a potential vector for gene therapy. Initially, their focus was on CNS diseases due to the wild-type properties that made it a promising candidate for such applications, particularly its tropism for neurons.1,2,3,4 However, when compared to other commonly used viral vectors, HSV-1 has a number of unique advantages that extend beyond its ability to infect cells. One of these advantages is the ability to accommodate large genes. The wild-type HSV-1 genome is approximately 150 kb, significantly larger than AAVs' 5 kb. Hence, HSV vectors can effectively hold inserts up to 150 kb in length, making possible the packaging of genes that are too large to be accommodated by other vectors.

Moreover, expression of native HSV-1 proteins that are conducive to immune evasion allow for potentially reduced toxicity and durability of transgene expression. It also does not integrate into the host cell genome in either active or latent states, eliminating the risk of insertional mutagenesis.

In addition, HSV-1 is highly stable in the environment and exhibits a high degree of mechanical stability.5 Its ability to resist shear forces enables higher yields during manufacturing.

One of the enduring concerns with HSV-1 vectors is the high level of exposure in the population to the native virus, which may reduce transduction efficiency or elicit undesirable immune responses. Of note, 70-90% of adults are seropositive for HSV-1, and 10-20% of people harbor the latent genome. However, clinical experience with chronic dosing of B-VEC, as explained later, has shown that the impact of serology on local transduction has been negligible – at least, when delivered topically to the skin.

Beyond gene therapy, HSV-1 has also been studied as an oncolytic for cancers of the skin and CNS. The first regulatory approval in this space was received by Amgen in 2015 for Imlygic (T-VEC), an HSV-1 modified to replicate in tumor cells and produce GM-CSF. It is indicated for the treatment of unresectable cutaneous, subcutaneous, and nodal lesions in patients with melanoma recurrent after initial surgery and is administered locally by injection.

Summary of HSV-1 vector features

| Pros |

|---|

|

| Cons |

|---|

|

| Other |

|---|

|

Krystal is engineering various HSV-1 vector constructs to address a variety of rare diseases and aesthetic conditions. Given the virus's natural tropism for the skin, it was a logical starting point to begin with skin-related conditions.

Dystrophic epidermolysis bullosa (DEB)

Krystal's first initiative was to develop a treatment for dystrophic epidermolysis bullosa (DEB), a rare genetic disorder caused by mutations in the COL7A1 gene.

The COL7A1 gene from the transcription start site to the polyadenylation sequence is 31 kb6, and its corresponding cDNA and mRNA are ~9 kb in size7, making it unsuitable for packaging in AAV vectors. The majority of type VII collagen (C7) protein is expressed in the skin by dermal fibroblasts and epidermal keratinocytes, although it is also expressed in other tissues, such as the prostate, endometrium, esophagus, spleen, and salivary glands.

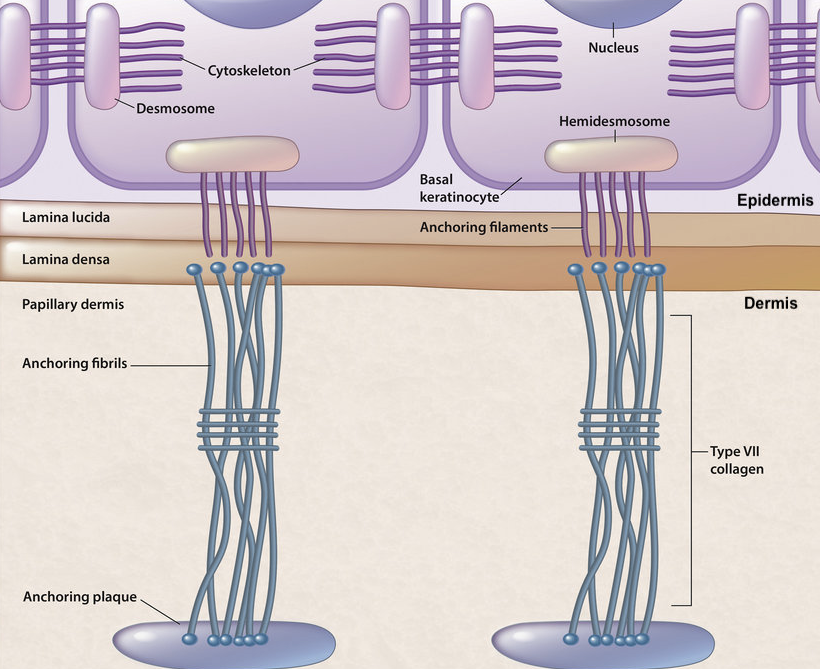

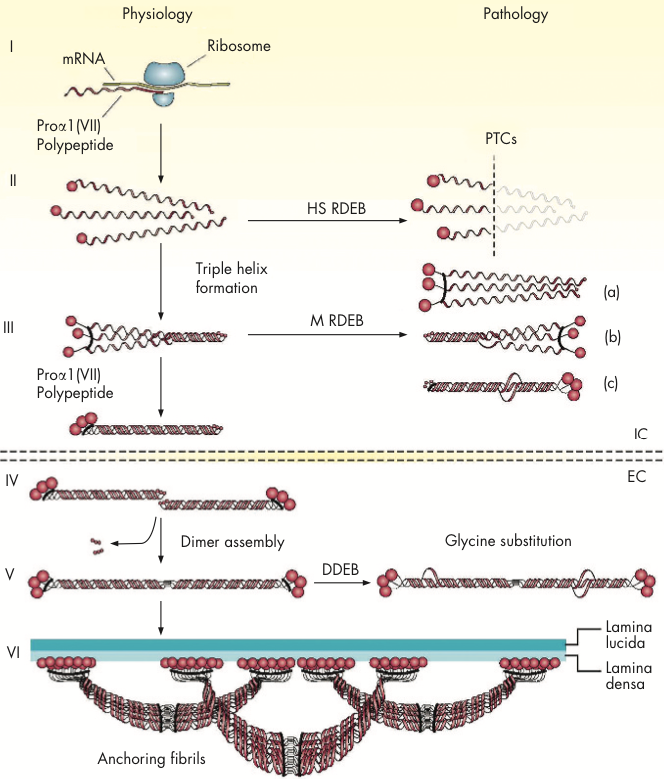

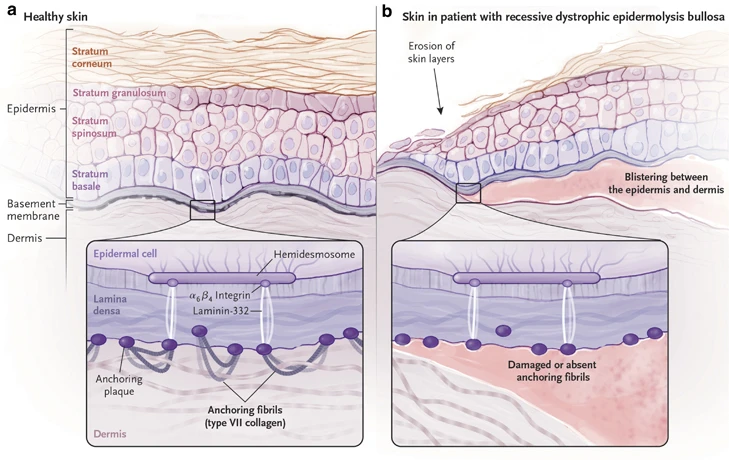

In the skin, C7 plays a crucial role in maintaining cohesion between the dermis and epidermis. In expressing cells, three pro-collagen α1 chains wind around each other to form the common collagen triple helix structure before secretion into the extracellular matrix. These triple helix structures self-assemble into larger fibrils, aligning multiple collagen molecules to create long, rope-like structures that extend from the dermis to the basement membrane zone (BMZ), the interface between the epidermis and dermis. There, they interact with other structural components, bridging to basal keratinocytes of the epidermis.

Anchoring fibrils are essential structures in the skin that provide structural support and stability. They enable the skin to withstand mechanical stress and prevent dermal-epidermal separation. Hence, mutations in the COL7A1 gene that result in the loss of C7 protein lead to dire consequences. More precisely, it is the definitive cause of DEB.

Mutations in other genes that are responsible for other proteins involved in the formation of anchoring fibrils give rise to different forms of epidermolysis bullosa (EB). For example, mutations in the COL17A1 gene resulting in the loss of type XVII collagen protein cause junctional epidermolysis bullosa (JEB), a condition with similar clinical presentation to DEB. Other genes, such as those encoding the subunits of the laminin-332 protein (connects to C7 in the basement membrane), are also implicated in JEB.9

Back to DEB

DEB is a heterogeneous disorder. There are over 700 distinct mutations in the COL7A1 gene that have been identified in patients. Of these, the most severe-causing are nonsense mutations resulting in premature termination codons (PTCs) and truncated proteins.10 These mutations lead to either instability or an absence of anchoring fibrils, with variable degrees of severity depending on their position in the gene. PTCs are characteristic of recessive DEB (RDEB).

Missense mutations are commonly identified in less severe and dominantly-inherited DEB (DDEB). These mutations are usually glycine substitution-mutations that cause instability in the triple helix structure. While mutant polypeptides are still able to assemble with wild-type ones and even form quasi-structured anchoring fibrils, the integrity of the resulting structure is compromised, ultimately leading to skin fragility and erosion. This form of DEB typically comes with milder phenotypic severity.

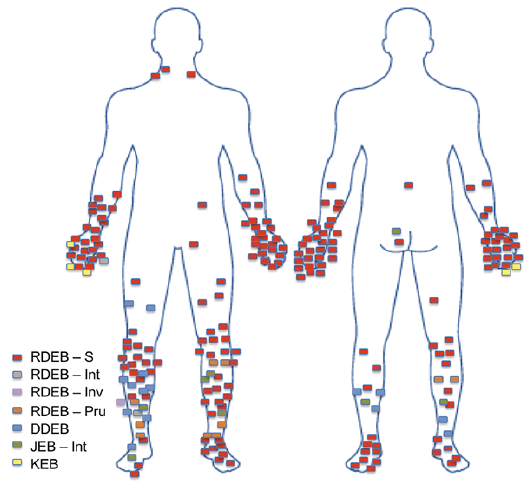

The hallmark of DEB is widespread subepidermal blistering and scarring in the skin.11 Up to 80% of a patient's body may be affected, but clinical presentation is highly variable, both inter- and intra-patient. The healing process of these wounds may extend over several weeks, and they often have a tendency to re-open. In many cases, these wounds can persist for prolonged periods, lasting for months or even years without proper healing, further adding to complications. Wounds can also become infected, leading to further inflammation. There are also usually extracutaneous manifestations in moderate-severe forms of the disease, such as blistering on the surface of the eye, esophageal strictures, and chronic renal failure from recurrent severe vesiculation in the genitourinary tract.

Patients are not only affected by wounds directly. With chronic wound healing, patients affected by DEB have an increased risk of squamous cell carcinomas (SCC). By age 35, patients with severe RDEB have a 67% cumulative risk of developing at least one SCC. Severe RDEB patients have a 70% cumulative risk of SCC-related death by age 45.13

Curing this disease is an immense challenge, with several obstacles hindering development of a one-time-treatment cure, assuming such a therapy is feasible. A major obstacle is that the skin turns over relatively quickly. The epidermal turnover period, a process mediated by epidermal stem cells, is 40-56 days.14 In addition, C7 has a cutaneous half-life of two or so months,15 so replacement of C7 must be continous. Hence, vector-based gene therapies to treat DEB must have potential for re-administration – that's where Krystal comes in.

Vyjuvek (Beremagene geperpavec/B-VEC)

Krystal's first product to market, Vyjuvek (B-VEC), is a modified HSV-1 vector carrying the COL7A1 gene. It is formulated for topical application to treat wounds in patients with genetically-confirmed dystrophic epidermolysis bullosa (DEB). The therapy comes with multiple firsts: it is the first gene therapy using an HSV-1 vector to gain approval, the first re-dosable gene therapy intended for chronic use, the first topical gene therapy, and the first approval for DEB in the US.

The following is a summary of Vyjuvek's development from pre-clinical studies to approval:

| Date | Milestone |

|---|---|

| 2016-2017 | Pre-clinical studies (Thomas Jefferson University & Krystal) |

| Dec 2016 | FDA grants rare pediatric disease designation |

| Nov 2, 2017 | FDA grants orphan drug designation |

| Mar 27, 2018 | IND submission |

| Apr 16, 2018 | European Commission grants Orphan Medicinal Product Designation |

| Apr 26, 2018 | IND cleared |

| May 10, 2018 | First patient dosed in Ph1/2 trial at Stanford University |

| May 24, 2018 | FDA grants Fast Track designation |

| Oct 15, 2018 | Interim results from Ph1 portion (n=2) announced |

| Dec 2018 | Ph2 portion of trial commences |

| Mar 29, 2019 | EMA grants PRIority MEdicines eligibility |

| Jun 24, 2019 | Ph2 portion interim results announced |

| Jun 24, 2019 | FDA grants Regenerative Medicine Advanced Therapy (RMAT) based on positive interim data from GEM-1 and GEM-2 study |

| Jul 28, 2020 | Pivotal Ph3 GEM-3 trial initiated |

| Aug 17, 2020 | First patient enrolled in GEM-3 trial |

| Oct 26, 2021 | Last patient completes GEM-3 trial |

| Nov 29, 2021 | Topline results from GEM-3 announced |

| Mar 2022 | Ph1/2 trial complete results published in Nature Medicine |

| Jun 22, 2022 | BLA submitted |

| Aug 18, 2022 | FDA accepts BLA, grants Priority Review designation with PDUFA date Feb 17 2023 |

| Sep 21, 2022 | EMA Pediatric Committee adopts positive opinion on pediatric investigation plan |

| Dec 14, 2022 | Ph3 GEM-3 data published in NEJM |

| Jan 5, 2023 | FDA notifies Krystal of 3-Month Extension of BLA PDUFA date to review additional manufacturing information relating to replaced hardware unit. New PDUFA date of May 19 2023 |

| May 19, 2023 | FDA grants approval & RPD PRV |

The following modifications have been made to wild-type HSV-1 to produce the B-VEC HSV-1 vector:

- Deletion of the immediate-early genes of HSV-1 that lead to viral replication (ICP4) and host cell destruction (ICP22). This frees up ~35 kb for the payload gene.

- Insertion of two functional copies of the full-length COL7A1 cDNA with their own expression control elements, inserted independently into each ICP4 locus (19 kb in total).

B-VEC is mixed into an HPMC-based excipient gel prior to administration. The treatment is given in a dropwise fashion uniformly across the surface area of a wound prior to bandaging.

Clinical data review

B-VEC was tested in two key clinical trials. The full data of these trials have been published in Nature Medicine and NEJM and can be viewed respectively here and here.*

*A note that these data differ slightly to what the FDA agreed upon due to differences in data handling methodologies.

The following are some highlights:

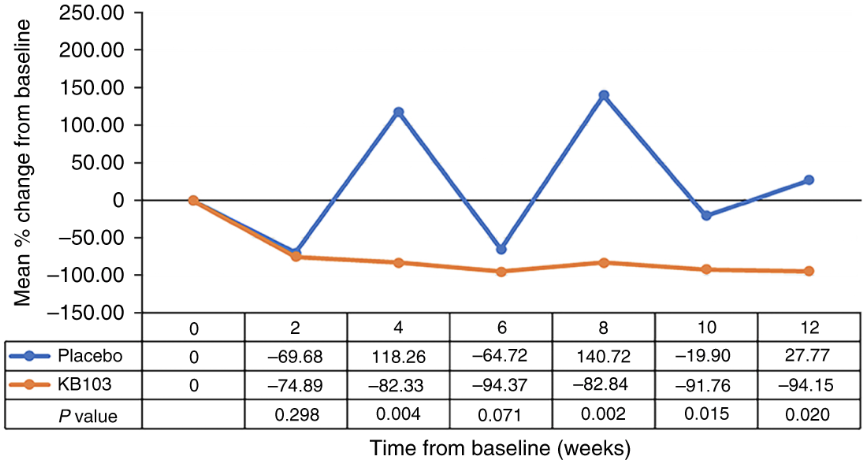

Phase I/II trial (NCT03536143) - GEM-1 (n=2) & GEM-2 (n=10) studies

This was a randomized, placebo-controlled trial evaluating intra-patient matched wounds from 9 patients with confirmed recessive DEB (RDEB). Matched wounds received B-VEC or placebo over 12 weeks. Three patients enrolled into a later phase of the trial and were considered independent for wound efficacy analyses.

Patients were dosed at varying frequencies throughout the study period, with the protocol eventually settling at once every 2-3 days until wound closure, in line with wound dressing changes. The protocol was amended multiple times throughout the study mainly due to the absence of precedence and the novelty of therapy. For an overview of these changes, refer to Extended Data Table 1 in the Nature Medicine article.

There were a total of 28 wounds treated with B-VEC or placebo in the efficacy evaluable population (18 B-VEC, 10 placebo). A total of 129 doses were given in the trial.

Safety

There were 21 adverse events reported: 1 moderate deemed unlikely to be related to drug, the remaining 20 mild. Among the mild events, 13 were deemed unlikely to be related to drug, 4 were possibly related (fever, rash, itching, peculiar taste), and 2 were probably related (application site discharge). All adverse events resolved and none necessitated changes to treatment frequency or dose. Importantly, there was no systemic vector shedding. There was also no excessive inflammation beyond the expected norm of normal wound healing.

Out of the 12 patients in the Phase 1 study, 7 were seropositive for HSV-1 at baseline. However, there was no impact on PD, indicating that serum antibodies against HSV-1 do not affect local transduction and transgene generation following topical administration. Further supporting this was a post-hoc analysis of the response rate among baseline anti-HSV-1 seropositive and seronegative subjects, with similar efficacy observed (FDA review document). In addition, patients with anti-C7 antibodies at baseline, and those that developed anti-C7 antibodies over the course of treatment were not impacted in their response to B-VEC (post-hoc analysis).

Efficacy

Wound closure was defined as >95% reduction in wound surface area from baseline for at least 2 consecutive weeks (measurements were taken at weeks 8 and 10 or weeks 10 and 12). Wound closure in the B-VEC group was achieved in all wounds after 3 months, except one chronic (5 year) dorsal foot wound. This wound had partial closure within 1 month of treatment. Upon re-administration of B-VEC, the wound closed completely within 7 days and remained closed throughout monitoring (8 months).

All other wounds remained healed for at least 3 months, while placebo wounds demonstrated the typical fluctuation of healing and re-blistering observed in patients with DEB.

There was a 79% difference in complete wound closure at weeks 8 and 10 or 10 and 12 between B-VEC and placebo-treated wounds (11/14 B-VEC-treated vs 0/7 placebo-treated, p=0.0026, McNemar's test).

The median time to wound closure was 13.5 days (8, 21) for B-VEC-treated wounds vs 22.5 days (8, 64) for placebo-treated wounds. Note here that the mean wound surface area in this trial was 9.08 cm2 (median 5 cm2).

The median duration of wound closure for B-VEC-treated wounds was 103 days (94, 118) vs 16.5 days (0, 66) for placebo-treated wounds. As stated before, C7 has a 2-month cutaneous half-life and the epidermis turnover rate is 4-8 weeks, and re-opening of B-VEC-treated wounds seem to be in line with these rates.

Biopsies taken from a subset of 7 patients demonstrated expression of the essential C7 NC1 and NC2 domains and the presence of mature anchoring fibrils (AFs) after B-VEC administration. All patients who had biopsies prior to treatment had a lack of AFs at baseline. These findings were consistent with observations in pre-clinical studies.

Phase III trial (NCT04491604) - Pivotal GEM-3 (n=31) study

This was a double-blind intrapatient randomized, placebo-controlled trial. The trial was designed to gain approval with a broad label, with the inclusion of chronic and recurrent wounds in both RDEB and DDEB patients. Participation in the trial was fairly open to a diverse group of patients with wounds of all sizes, but did require confirmation of DEB diagnosis by genetic testing, and at least two uninfected wounds of similar size.

Patients were treated for a total of 6 months, with primary wounds treated once-weekly at a fixed dose until wound closure. Wounds that re-opened would be re-dosed at an assigned dose depending on the size of the wound until wound closure. Secondary wounds were also treated in the trial in an open-label manner to contribute to safety data.

The maximum weekly dose was defined by age: 1.6x109 PFU/week for patients aged 6 months to 3 years, 2.4x109 PFU/week for ages 3-6 and 3.2x109 PFU/week for patients aged 6 and older.

The primary endpoint was complete wound healing at 6 months (weeks 22 and 24 or weeks 24 and 26), with complete wound healing defined here as 100% wound closure from the exact wound area selected at baseline (skin re-epithelialization without drainage).

There were 62 wounds assessed (31 pairs from 31 patients). Five patients from the Ph1/2 trial enrolled in this trial, with a 1+ year wash-out period between their last dose and first visit in this trial. There were 19 pediatric patients.

Of the 31 patients enrolled, 30 had RDEB and 1 had DDEB. Primary wounds ranged in size from 2.3 to 57.3 cm2 (median 10.6 cm2 B-VEC-treated, 10.4 cm2 placebo-treated).

Safety

The majority of TRAEs were mild or moderate in severity and consistent with observations in the Phase 1/2 trial. Of the 31 patients evaluated, 18 had at least one AE, with 45 reported in total. There was one case of mild erythema that was considered to be related to B-VEC. There were a few SAEs; all were deemed unrelated to treatment.

At baseline, 14/22 patients had antibodies to HSV-1, with seroconversion having occured in 6 of the 8 remaining patients by 6 months. Of 22, 1 had antibodies to C7 at baseline, with seroconversion occuring in 13 of 18 patients by 6 months. Importantly, treatment response was not associated with either serological status, and there were no clinically significant immunologic reactions reported.

Overall, this represents a very acceptable safety profile.

Efficacy

At 6 months, the percentage of primary wounds with complete healing was 67% for those treated with B-VEC and 22% for the placebo group (95% CI: 24 to 68, P=0.002), meeting the primary endpoint of the trial.

At 3 months, complete wound healing was observed in 71% of wounds treated with B-VEC and 20% of wounds in the placebo group (95% CI: 29 to 73, P<0.001). This was the key secondary endpoint.

The single DDEB patient enrolled in the trial was also a positive responder, having complete wound healing at 6 months in the B-VEC-treated wound but not in the placebo-treated wound.

The durability of response to B-VEC treatment was evident with 50% of wounds achieving complete healing at both 3 and 6 months, compared to only 7% in the placebo group (95% CI: 23 to 63). A numerically higher percentage of wounds treated with B-VEC had complete closure across various time points compared to placebo.

Responses in B-VEC-treated wounds were numerically higher than placebo-treated wounds across all wound-size subgroups (<20 cm2, 20-40 cm2 and 40-60 cm2) and in all ages (≤12 years, >12 and ≤18 years, and >18 years), but these subgroups were not powered for statistical significance. There was also a trend towards decreased pain in B-VEC-treated wounds at weeks 22, 24 and 26, consistent with wound healing.

GEM-3 open-label extension trial (NCT04917874)

This trial is an ongoing open-label extension, with ~50 patients enrolled. Patients will be treated once weekly for 78 weeks. Around 10 of the patients enrolled have DDEB.

Interim safety data from this study can be viewed here. There were no new safety signals identified.

DEB Market

Management of DEB

For decades, treatment of DEB has generally been limited to supportive therapy comprised of wound care (cleaning wounds and applying dressings), pain management, and addressing complications.

Open wounds must be dressed to reduce the risk of infection. Petrolatum-impregnated gauze, hydrogels, fenestrated silicone dressings or absorbent foam silicone dressings are commonly used. The wound care process can take an hour or longer each day and dressings are typically changed daily or every other day.

In the EU, Filsuvez/Oleogel-S10, a topical gel containing birch triterpenes from birch bark was approved last year for EB wounds. However, the treatment was rejected by the FDA in February 2022, with additional confirmatory evidence requested to prove the treatment's efficacy.

The complications of DEB are numerous and can lead to substantial costs. In the US, supportive therapy treatment is estimated to cost in total between $200,000 and $400,000 annually per patient (KRYS 10-K). Despite this financial burden, there have been no available options for patients to address the underlying cause of the disease – that is, until the approval of Vyjuvek.

Vyjuvek is applied once a week during regular dressing changes with minimal disruption to the care patients are accustomed to. It is non-invasive and easy to apply, but does require administration by a healthcare professional.

One of the standing issues is that B-VEC eventually gets washed out, and there are no data yet to suggest that it could prevent the formation of blisters at treated sites indefinitely after repeated long-term use. As described earlier, this issue is an inherent difficulty related to skin dynamics and the nature of the disease. While a one-and-done therapy would be a perfect solution for patients, the key advantage of B-VEC is that it can be re-dosed to heal wounds with a very favorable safety profile.

Eliminating the need to ever have to go through the cumbersome wound-dressing process would obviously bring immense satisfaction to patients. In a survey of EB patients held by Pachyonychia Congenita Project & DEBRA in 2018, 67% rated a decrease of frequency in blistering or wounding as the most important outcome for a potential drug (sample size unknown). Other options in the survey included stopping or slowing down the progression of EB but with potential side effects (27%), increasing the speed at which a wound heals (3%), and lessening but not totally relieving symptoms with few side effects (3%).

Long-term treatment with B-VEC has been encouraging. Krystal has observed and expects that the number of vials patients will use will reduce from 52 per year (i.e. once a week at max dose) to under 30, as wounds close up and remain closed for relatively longer periods of time.

Prevalence & Incidence of DEB - an important part of the equation

Prevalence estimates of DEB around the world range from 3.0 to 20.4 per million people.

The prevalence of DEB in the US was estimated to be 3.26 per million or approximately 1100 patients (1.49 per million DDEB, 1.35 RDEB, 0.42 unknown) from the National Epidermolysis Bullosa Registry (January 2002 data, which showed prevalence had increased from 2.38 per million in 1990).16 Note this represents patients that could be found in the NEBR (i.e. diagnosed and registered). The incidence over a 16-year period (1986-2002) was 6.65 per 1 million live births (2.12 per million DDEB, 3.05 RDEB, 1.48 unknown DEB). Taking this number would give an estimated 24 new cases a year (8 DDEB, 11 RDEB, 5 unknown). There is likely an underrepresentation of DDEB cases here, as they can sometimes have mild manifestations and remain undiagnosed.

Eichstadt et al. (2019) estimated 3,850 RDEB patients in the US with a simulation approach (genetic modelling).17 They estimate that approximately 250 and 330 infants are born each year in the US and EU respectively with RDEB. Of these, 10 and 13 respectively are expected to have the most severe subtype of RDEB (Hallopeau-Siemens), where patients rarely survive beyond age 30. The remainder of patients are expected to have various other subtypes of RDEB.

In Germany, the prevalence of DEB is estimated to be 12.16 per million or about 1000 people (based on multiple sources) with an incidence of 15.58 per million live births. A cross-sectional study found 578 cases of DEB (40.3% DDEB, 48.4% RDEB, 11.3% unknown).18

In England and Wales, the average incidence of DEB per million live births between 2002 and 2021 was 26.1 (data from NHS).19 The prevalence was reported to be 10.7 per million or about 640 people.

A Spanish group (Hernandez-Martin et al. 2013) identified 152 living DEB patients in Spain. An interesting finding was that 65% of these patients had not had a genetic diagnosis and 77% were not being followed up in specialized centers.

The prevalence of DEB in Japan was estimated in 1994 to be 2.62 per million (1.02 per million DDEB, 1.60 RDEB) or about 330 people, although 333 JEB and DEB patients are certified to receive medical care (2010).20 There are about 2-5 DEB patients for every JEB patient (my own estimate), so I assume 260 of those are DEB patients.

Krystal Biotech management estimate that there are 9000 DEB patients in reimbursable markets worldwide. They estimate 3000 of these to be in the US, with 1100 already identified through medical records. They estimate a further 3000 patients in Europe, and the remaining 3000 in the rest of the world. According to the company, over 2500 people globally have been diagnosed with DEB.

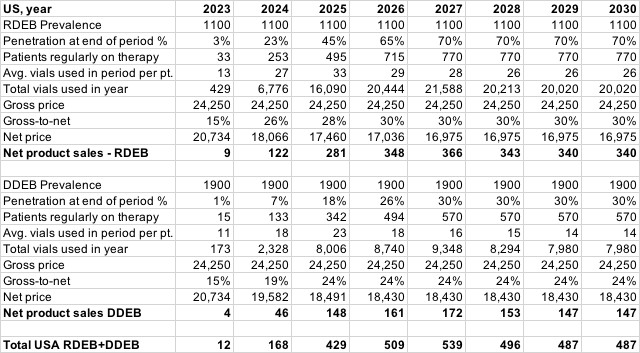

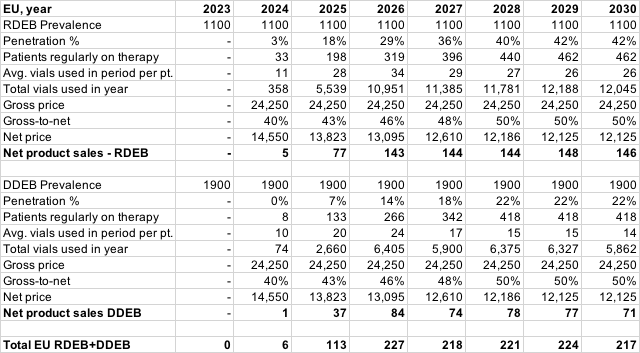

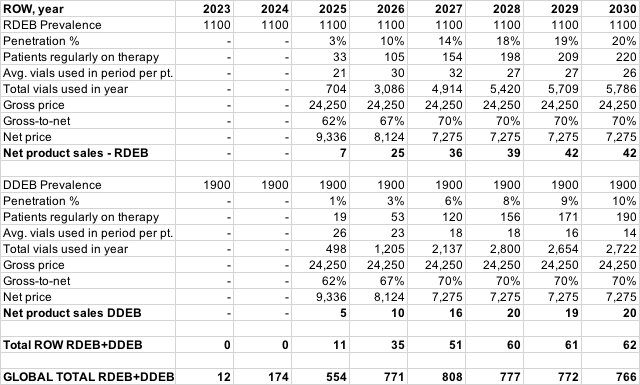

Forecasting Vyjuvek sales

Looking through the Krystal ball

Vyjuvek received a broad label to treat wounds in patients aged 6 months and older with mutation(s) in COL7A1 (i.e both DDEB and RDEB). The therapy is expected to be made available in the US through a limited specialty pharmacy network sometime this quarter (Q3 2023). The company has 17 sales representatives across the US supported by 10+ patient access, community education and regional medical directors. The sales team has been in the field preparing for launch since mid-end 2022.

The list price of Vyjuvek is $24,250 per vial, which annualizes to $1,261,000 per patient at the maximum dose per week. Commercial payers are given an annual patient consumption cap equal to $900,000, with all vials in the remainder of the year free when the cap is reached. They must cover to the label in order to qualify for this cap. The insurance coverage split in the US for the DEB population is approximately 5% Medicare, 45% Medicaid and 50% commercial (according to Krystal).

Krystal estimates that the global market opportunity for Vyjuvek is over $750 million (June corporate presentation).

Uptake will obviously begin most rapidly with the most severe of RDEB patients and those in close proximity to centers of excellence, but I expect demand will also be patient-driven by moderate and mild cases of DEB.

The maximum weekly dose for patients aged 3 years and older is 3.2x109 PFU. This dose can effectively cover approximately two or three large wounds (40-60 cm2 each), four medium-sized wounds (20-40 cm2 each), or eight small wounds (under 20 cm2 each).

Patients would have a mix of different wounds of different sizes and different levels of severity depending on various factors, but I would assume that all patients in the initial rollout will be using the maximum weekly dose every week for quite some time.

Wound cover in patients with DEB?

There isn't an abundance of data available to gauge the average area of wounded skin in patients with DEB. Patient variability can also be exceptionally high, so using an estimation of this may not be a reliable predictor of how much Vyjuvek will be used.

Nonetheless, a survey21 conducted with EB patients and their caregivers yielded the following findings:

| Avg. % body covered in wounds | DDEB (n=31) | RDEB (n=53) |

|---|---|---|

| <10% | 12 (38.7%) | 6 (11.3%) |

| 10-30% | 9 (29.0%) | 15 (28.3%) |

| >30% | 10 (32.3%) | 32 (60.4%) |

Note that the majority of RDEB patients in this survey reported that wounds covered >30% of the body, which is quite significant. The area of 'wound' cover reported by survey participants may have included re-epithelialized erosions that continue to be dressed.

For reference, the surface area of skin in adults is about 16,000-18,000 cm2 and the palm of an adult hand is about 130-160 cm2.

In the Phase I/II trial of EB-101 (potential therapy discussed later), the average wounded body surface area in patients was 13.7% (range 4-28%, n=7, mean age 23 years).22 Every patient in that trial had generalized severe (Hallopeau-Siemens) RDEB.

Number of wounds per patient?

A report from a global registry survey of 85 RDEB patients with 1226 wounds found a mean (±SD) of 11 (±10) recurrent wounds and 3 (±2) chronic open wounds per patient.23 The survey also asked patients and caregivers to estimate the size of these wounds, with the following results: of the recurrent wounds, 52% were small, measuring less than 2.5 cm in diameter (<5 cm2), 38% were of medium size between 2.5 and 7.5 cm in diameter (5-45 cm2), and the remaining 10% were large, exceeding 7.5 cm in diameter (>45 cm2 in area). Among the chronic wounds, 30% were small, 36% were medium, and 34% were large.

Teng et al. (2019) saw a similar distribution of wound type in a natural history study of 128 patients with RDEB with a total of 1463 wounds (mean of 11.4 wounds per patient). In that study, 27% of wounds were chronic (mean 3.1 per patient) and 72% were recurrent (mean 8.3 per patient). Chronic wounds had a mean size of 66.3 cm2, and recurrent wounds had a mean size of 44.7 cm2.

Note that there is a considerable amount of patient variability here and some biases that would make using this to reasonably estimate average wound cover per patient challenging. These patients may also not be representative of the broader DEB population. You may use these data as you wish.

An attempt to estimate Vyjuvek use

Krystal management has indicated that patients would be on induction therapy for about 18-24 months before steady-state usage of <30 vials a year, although it is unclear which kind of patient in terms of severity this represents and the rate at which Vyjuvek use will presumably decline. You can try to estimate this, but there are a number of factors with significant variability that complicate the equation.

Management has also indicated from experience that a mild DEB patient (mostly DDEB) could have a handful of blisters of a number under 10. I assume such a patient (5-10 blisters with total area 250-500 cm2, using Teng data) would initially need 4-8 weeks of therapy at the max dose to treat all wounds until they are closed (2-4 max-doses needed to cover all wounds, 2 weeks each for average wound closure). Assuming all wounds respond to treatment and that wounds are closed for 100 days each, this would annualise to ~14-28 vials.

The following represents a rudimentary model of potential Vyjuvek sales. There is a lot of uncertainty here and a number of variables that can dramatically change the outcome, so do not rely on this, and keep in mind that these simply represent an opinion.

I have tried to factor in the following assumptions in this model:

- Patients early to therapy will predominantly have moderate-severe RDEB and use the maximum dose (1 vial a week).

- As patients progress on therapy, wounds close and remain closed for longer periods of time. I estimate Vyjuvek use in the most severe RDEB patients reducing from 13 vials/quarter to 6.5 vials/quarter at a somewhat steady rate over 18 months.

- I assume patients that get on therapy later in the launch will have milder cases and start at 9-12 (RDEB) or 8-10 (DDEB) vials/quarter on average.

- DDEB patients will be slower to therapy, have less blisters to treat and get into steady-state usage quicker (I have mostly discounted Vyjuvek use in DDEB patients).

- Median time to wound closure on Vyjuvek ~14 days.

- Median duration of wound closure ~100 days.

- Gross-to-net adjustment mid-teens in 2023, increasing as Medicaid patients get access and Patient Consumption Adjustment is triggered.

- I assume no issues are encountered with EU and ROW applications.

- I assume the EU/ROW DEB population is less accessible than the US.

Some possible issues with this forecast:

- It may be underestimating the severity of the disease and how many vials patients in later phases of the launch will use.

- Peak market penetration could be too conservative.

- Launch may be less aggressive than I have assumed.

- Prevalence of DEB may be underestimated due to underdiagnosis. I believe I am being conservative in the model based on the 1100 already identified patients in the US (mostly patients with RDEB). I have estimated similar numbers for EU and ROW.

- Patients may be more difficult to access than I have assumed - dosing requires an HCP and not every DEB patient will be living near a center of excellence and have covered. At-home administration solves this but travelling HCPs will need to learn how to dose and patients will need to get started in clinics. I have tried to factor this in with conservative penetration.

- Number of undiagnosed DDEB patients may not be as high as I have assumed.

- I have not accounted for potential additional indications (treatment of ocular complications could potentially bring in significant additional revenue if approved).

- Vials are single-use, so there may be a lot of discarded product when treating wounds that do not require the maximum dose – average no. of vials used per patient may be underestimated.

- Patients may need to be treated at a higher frequency for a longer period of time than what I have assumed.

- I have made other assumptions such as gross-to-net adjustments and global pricing estimates that may be incorrect.

If you want to see further how I got to these numbers, you can download the spreadsheet here.

Note: These are my own personal rough estimates based on my own opinions and do not factor in all variables. They are highly speculative and will differ drastically from actual results. I may continue to change this as I think further about this and as more information comes out. This is not a recommendation to invest and should not be used as guidance to make an investment decision. It is simply my opinion and you may do what you wish with it.

Competitive Landscape

There is likely to be no direct competition to Vyjuvek in the near future. Abeona Therapeutics has an ex-vivo gene therapy surgical product that has been submitted to the FDA for review. The main component of the therapy, EB-101, is a retroviral vector encoding the gene for COL7A1. If successful, it may receive regulatory approval in the US in late Q1-early Q2 of 2024.

The treatment is an autologous transplant procedure that entails harvesting cells from the patient, transducing them with the vector, and then expanding them to produce large keratinocyte sheets for grafting.

The Phase III trial, VIITAL (NCT04227106), showed significantly improved wound healing compared to matched ungrafted wounds, without systemic TEAEs (n=11 RDEB patients aged 6+, a total of 43 large chronic wounds that were required to be ≥20 cm2 and present for ≥6 months). Wound healing in this trial was considered as occurring on an improvement of ≥50% from baseline. Complete wound healing from baseline was 16.3% at Week 24 (vs 0% placebo, p<0.05).

If approved, this therapy will likely be used in conjunction with Vyjuvek, with the most severe RDEB patients receiving both EB-101 and Vyjuvek in wounds of different sizes and location.

There are cases where EB-101 may not be preferred; extremities at joints, smaller wounds where surgery is not warranted, and new wounds which may close without the need of surgery. Additionally, it takes ~25 days to manufacture 40 cm2 sheets (from biopsy to fully formed sheets 1-3 cell layers thick, according to Abeona corporate presentation).

These grafts also typically require general anesthesia and come with other surgical and hospitalization-associated costs, as well as post-operative graft immobilization. In the Phase 1/2a trial (NCT01263379, n=7), all participants were hospitalized for up to 8 days with immobilization.24

Abeona conducted a survey of KOLs who unanimously said that almost all patients will need both products in the course of disease (Abeona June presentation slide deck, slide 23, n=5 pediatric dermatologists specializing in EB).

The anatomical distribution of where primary SCC arises is an interesting consideration for Vyjuvek; most SCCs occur on the limbs, particularly at the joints of hands and feet (areas most prone to chronic ulceration, scarring and infection). One might speculate Vyjuvek to reduce these occurences and provide additional value to patients, although there is currently no direct data available with either Vyjuvek or EB-101 to support this.

Castle Creek Biosciences has a similar ex-vivo cell-based gene therapy that they acquired from Fibrocell Science in December 2019. Fibrocell was developing the product in collaboration with Intrexon, where both Krishnans worked. The collaboration deal was brokered just before they left the company to start up Krystal.

The therapy, D-Fi (FCX-007), is comprised of autologously-derived dermal fibroblasts modified with a lentiviral vector to express C7. The cells are injected intradermally. The therapy is currently being tested in a Phase III clinical trial (NCT04213261).

While this therapy overcomes the hospital-associated costs of EB-101, it would still require collection of cells from the patient and cell manufacturing. The trial has moved slowly with initiation in June 2020 and the first patient dosed in November 2020. The company withdrew a $100 million IPO originally filed in July 2021 and raised $113 million in May 2022 to provide additional capital for completion of the Phase 3 trial. The clinical trial is active, and stopped recruiting between December 2021 and August 2022 (6 enrolled, 20-24 were initially anticipated). I could not find any recent updates on the program.

There are other therapies being developed, but it is difficult to see at the present time how they will replace Vyjuvek or cut significant revenue. Krystal Biotech, however, faces the challenge over the next few years of identifying patients and bringing them into the network.

The full global pipeline for DEB can be viewed through the 'Data' tab or by clicking here.

Potential additional indications for Vyjuvek

The company is looking to broaden Vyjuvek's label to include the treatment of ocular complications that commonly occur in patients with DEB (usually in the recessive form). They presented clinical data at the Association for Research in Vision and Ophthalmology (ARVO) Annual Meeting on April 23 this year of a patient treated under compassionate use.

Krystal management estimate that there are over 700 DEB patients in the US with ocular complications (over half of the patients diagnosed with RDEB), and over 2000 worldwide in reimbursable markets.

There is a concern for HSV-1-related Herpes Simplex Keratitis (HSK) here - however, the toxicology report submitted to the FDA showed no changes in HSK scoring in B-VEC-treated eyes (mouse study). In addition, the DEB patient that was treated under compassionate use was treated for recurrent corneal conjunctivalization on more than 24 occasions over 7 months and did not present with any B-VEC-related AEs and with no evidence of HSK.

Treatment resulted in full corneal healing by 3 months and significant visual acuity improvements from hand motion to 20/40 at 7 months (last evaluation, ongoing treatment). Topical B-VEC was instilled 3 times a week for the first two weeks, followed by a once-weekly dose until healing of the cornal epithelium, and then a maintenance dose of once every month. There were no changes made to the formulation for this use. Note that this is a single patient, so more data are required to make reasonable conclusions. Krystal is planning to meet with the FDA to align on a path to develop an ophthalmic formulation.

The company is also interested in treating DEB wounds from birth. While the period of 6 months from birth to the indicated age may not seem lengthy, wounds are especially prevalent in neonates due to damage sustained in the womb and in birth, so this would be an important advancement for patients. In a retrospective study,26 94% of patients with RDEB and 46% of patients with DDEB presented with blisters at birth (n=16 and n=24, respectively). Patients are usually diagnosed early in life, so this would be a good step to get patients on therapy early. Disease activity in patients with DDEB also sometimes diminishes with age,27 so early-life treatment may be more critical for some than others.

Pipeline

Beyond Vyjuvek, the company is using their STAR-D platform to develop a compelling pipeline of re-dosable HSV-1-vector gene therapies.

The company is also exploring alternate routes of administration. One of the main challenges with gene therapy is being able to target tissues beyond the liver. Krystal is tackling this with different formulations of their vector.

Of these are two nebulized to target genetic disorders affecting the lungs; KB407 and KB408.

Delivering non-viral vectors to the lungs poses some challenges, such as the need to penetrate the mucus and glycocalyx layers for effective cellular transduction as well as the potential risk of encountering immune responses to the vector. Being able to prove efficacy in this space would generate significant interest.

Beyond the lungs, the company is also using their experience with B-VEC to explore additional indications in dermatology and ophthalmology.

The following is a summary of the company's pipeline:

KB105

The lead program is KB105, an HSV-1 vector delivering the TGM1 gene in patients with TGM1-deficient autosomal recessive congenital ichthyosis (ARCI). These are a group of rare skin disorders characterized by scaling (keratinization) and erythema. The therapy is delivered topically in a similar fashion to B-VEC. A phase I clinical trial was completed with an encouraging safety profile. A phase II trial (NCT05735158) is expected to begin in the second half of this year.

KB407

A nebulised HSV-1 vector carrying the CFTR gene for the treatment of cystic fibrosis (CF). There are over 30,000 patients in the US with CF and over 70,000 worldwide. Of these, 10% are not amenable to currently available therapies, such as those with Class I CFTR mutations who have little or no expression of the CFTR protein.

Pre-clinical in-vivo studies showed effective delivery of the CFTR gene in WT and CFTR double-knockout mice, without induction of inflammation or cell infiltration. Strong expression of hCFTR mRNA was also observed in NHPs recieving multiple doses, with broad distribution throughout the lung tissue. Long term effect and safety is unclear and will need to be looked at closely in clinical trials. Patients with Class I CFTR mutations who do not express CFTR may not have built up central tolerance and there is a potential risk of immunogenic reactions when the CFTR protein is reintroduced if recognised by the immune system.

A single-center Phase I clinical trial (NCT05504837, n=20) is currently recruiting patients at Yale. The first patient was dosed on July 3 2023. The trial will have three cohorts with patients receiving either a single dose, two doses (14 days apart), or four (7 days between each). The four-dose cohort will be randomised against placebo.

Another Phase I clinical trial was initiated in March 2023 and is currently recruiting in Australia (NCT05095246, n=13) with a similar design to the US trial, minus the placebo arm.

KB408

A nebulized HSV-1 vector delivering the SERPINA1 gene to patients with AATD-associated lung disease. An IND application is expected to be filed in the second half of this year with a phase I clinical trial expected to start shortly thereafter.

KB104

A topical HSV-1 vector delivering the SPINK5 gene to patients with Netherton syndrome. An IND application is expected to be filed in the second half of this year.

KB707

An HSV-1 vector delivering the genes encoding IL-12 and IL-2 for local delivery in solid tumors. This candidate was recently announced as the company's first oncology program. The FDA has accepted the IND application for KB707 and the company expects to initiate a Phase I trial in the second half of this year. A nebulized formulation is also being explored, with filing of an IND amendment to include this formulation later this year and anticipated evaluation in a clinical trial in the first half of 2024.

Jeune Aesthetics Inc.

KB-301

As stated previously, Jeune is Krystal's wholly-owned subsidiary with a pipeline for aesthetic-related conditions.

Management has indicated that they are exploring a potential spin-out of this segment at some point, with KB-301 leading the way. KB-301 is an intradermally-injected HSV-1 vector delivering the COL3A1 gene as a potential treatment for fine lines and wrinkles, specifically lateral canthal lines at rest. Type III collagen is the second most abundant collagen in connective tissue. If successful, this product would be the first approved injectable to improve lateral canthal lines at rest. One may question the acceptability of gene therapies for aesthetic purposes, but botulinum toxin (which treats dynamic lines) is a juggernaut with a $7 billion+ global annual market, and that is a toxin that paralyzes neurons. On the other hand, the HSV-1 vector Krystal uses has demonstrated an excellent safety profile in the skin so far with B-VEC, along with significant re-dosing potential. Efficacy may wane at some point without re-treatment; however, data released in November 2022 from the Cohort 2 extension of the Phase 1 trial (NCT04540900) demonstrated sustained benefits up to 9 months after the last dose. All reported AEs were transitory, mild-moderate and injection-site related. A note that most drug-related AEs for B-VEC were also associated with intradermal administration (this route was trialled early on in B-VEC development).

Overall, this treatment could end up being very valuable if proven efficacious, passes regulatory review, and is marketed effectively, but there is some way to go. Data from the final cohort of the Phase 1 trial are expected to be released in the second half of this year (n=20).

Other pipeline

The company is exploring additional ophthalmological indications with topical, intravitreal and subretinal formulations. Stargardt Disease was listed as a 'sample indication' in the most recent corporate presentation, a disease where the underlying gene (ABCA4) is too large for packaging in AAV vectors.

There are also additional candidates for aesthetic conditions in pre-clinical development uncovered in this report.

Beyond this, the approval of B-VEC was a major de-risking event for the company. Krystal could apply its STAR-D platform to many other genetic disorders; for example, delivering laminin-332-encoding genes to treat different forms of junctional EB. Unlike DEB, JEB is genetically heterogenous, but the majority of causative mutations are found in the three genes encoding the subunits of the laminin-332 protein (mostly LAMB3).28

Potential Risks to Pipeline

- HSV-1 vector may have lower transduction efficiency than expected in tissues beyond the skin, although ability to re-dose is advantageous in this aspect.

- Risks related to long-term use of HSV-1 vector (waning of efficacy, safety). While topical application of B-VEC has not shown any safety signals with patients on years of therapy, the skin and lungs are characteristically distinct (e.g. turnover rate of cells, local immunology).

- Expression of proteins in off-target cells may have unintended consequences (e.g expression of IL-2/IL-12).

Note. This is not an exhaustive list.

Valuation

Krystal recently announced gross proceeds of $160M from a private placement, bringing their cash and cash equivalents (including short and long-term investments) to ~$510M (as of Q1 2023). The company also received a PRV on the approval of Vyjuvek which could be valued around $100M.

If Vyjuvek sales play out as forecasted above (a big if, with still lots of uncertainties that could take things either way), I would value the company at ~$4.5B, or ~$165/share (10% discount rate on cash flows, 3% on reinvested cash, in addition to $100M PRV value). This represents a ~30% upside from the current price of $126/share at the time of the publishing of this article.

You can download the model for free on Buy Me A Coffee.

This is a runoff DCF model that assumes that the company exists to serve the cash flows of private owners with cash reinvested at 3%. It relies heavily on Vyjuvek revenue projections and does not factor in any potential additional indications. Operational expenses are my own estimations. The pipeline has not been included in this calculation, although I believe some platform value should be assigned. The value of the company's property and equipment ($163 million) and other non-liquid assets have also not been included.

There is obviously significant downside if Vyjuvek sales do not meet expectations, as well as many other risks and uncertainties – you should do your own research and come to your own conclusions, as well as read the disclosure statements below.

Disclosure: I am a shareholder of Krystal Biotech as of the time of the publishing of this article. I may exit from this position at any given time without notice. Data presented in this article have been obtained from third-party publications and sources. I do not guarantee the accuracy of this data and all information presented here should be checked and verified accordingly. Readers of this article should each make their own evaluation and judgement of the mentioned companies and of the relevance and adequacy of the information provided. Readers should make other such investigation as deemed necessary. The article is intended for informational purposes and any forecasts or forward-looking statements represent an opinion based on publicly-available information. It is not investment or financial advice. I am not an oracle. Forecasts and forward-looking statements are subject to significant risks and uncertainties. All investments have risks of loss associated with them. Investors should do their own due diligence to evaluate all potential risks and come to their own conclusions before making investment decisions.

Medical Advice Disclaimer: The material presented on this website is not medical advice and not intended to be a substitute for professional medical advice, diagnosis or treatment. Always seek the advice of your physician or other qualified health provider regarding a medical condition and with any medical-related questions you may have and never disregard professional medical advice or delay in seeking it because of something you have read on this website.

Additional disclosure: This article contains trademarks, trade names, copyrights, figures and data of Krystal Biotech and other companies, which are the property of their respective owners.

Skip to comments

References

1. Jacobs A, Breakefield XO, Fraefel C. HSV-1-based vectors for gene therapy of neurological diseases and brain tumors: part II. Vector systems and applications. Neoplasia. 1999 Nov;1(5):402-16. doi: 10.1038/sj.neo.7900056. PMID: 10933055; PMCID: PMC1508111.

2. Marconi P, Krisky D, Oligino T, Poliani PL, Ramakrishnan R, Goins WF, Fink DJ, Glorioso JC. Replication-defective herpes simplex virus vectors for gene transfer in vivo. Proc Natl Acad Sci U S A. 1996 Oct 15;93(21):11319-20. doi: 10.1073/pnas.93.21.11319. PMID: 8876133; PMCID: PMC38055.

3. Fink DJ, Glorioso JC. Engineering herpes simplex virus vectors for gene transfer to neurons. Nat Med. 1997 Mar;3(3):357-9. doi: 10.1038/nm0397-357. PMID: 9055868.

4. Kramm CM, Chase M, Herrlinger U, Jacobs A, Pechan PA, Rainov NG, Sena-Esteves M, Aghi M, Barnett FH, Chiocca EA, Breakefield XO. Therapeutic efficiency and safety of a second-generation replication-conditional HSV1 vector for brain tumor gene therapy. Hum Gene Ther. 1997 Nov 20;8(17):2057-68. doi: 10.1089/hum.1997.8.17-2057. PMID: 9414254.

5. Liashkovich, I., Hafezi, W., Kühn, J. E., Oberleithner, H., Kramer, A., & Shahin, V. (2008). Exceptional mechanical and structural stability of HSV-1 unveiled with fluid atomic force microscopy. Journal of cell science, 121(Pt 14), 2287–2292. https://doi.org/10.1242/jcs.032284

6. Christiano, A. M., Hoffman, G. G., Chung-Honet, L. C., Lee, S., Cheng, W., Uitto, J., & Greenspan, D. S. (1994). Structural organization of the human type VII collagen gene (COL7A1), composed of more exons than any previously characterized gene. Genomics, 21(1), 169–179. https://doi.org/10.1006/geno.1994.1239

7. Christiano, A. M., Greenspan, D. S., Lee, S., & Uitto, J. (1994). Cloning of human type VII collagen. Complete primary sequence of the alpha 1(VII) chain and identification of intragenic polymorphisms. The Journal of biological chemistry, 269(32), 20256–20262.

8. Abdo, J.M., Sopko, N.A. and Milner, S.M. (2020) ‘The applied anatomy of Human skin: A model for regeneration’, Wound Medicine, 28, p. 100179. doi:10.1016/j.wndm.2020.100179.

9. Fine JD. Inherited epidermolysis bullosa. Orphanet J Rare Dis. 2010 May 28;5:12. doi: 10.1186/1750-1172-5-12. PMID: 20507631; PMCID: PMC2892432.

10. Varki R, Sadowski S, Uitto J, Pfendner E. Epidermolysis bullosa. II. Type VII collagen mutations and phenotype-genotype correlations in the dystrophic subtypes. J Med Genet. 2007 Mar;44(3):181-92. doi: 10.1136/jmg.2006.045302. Epub 2006 Sep 13. PMID: 16971478; PMCID: PMC2598021.

11. Christiano, A. M., Anhalt, G., Gibbons, S., Bauer, E. A., & Uitto, J. (1994). Premature termination codons in the type VII collagen gene (COL7A1) underlie severe, mutilating recessive dystrophic epidermolysis bullosa. Genomics, 21(1), 160–168. https://doi.org/10.1006/geno.1994.1238

12. Vanden Oever M, Twaroski K, Osborn MJ, Wagner JE, Tolar J. Inside out: regenerative medicine for recessive dystrophic epidermolysis bullosa. Pediatr Res. 2018 Jan;83(1-2):318-324. doi: 10.1038/pr.2017.244. Epub 2017 Nov 1. PMID: 29593249.

13. Fine JD, Johnson LB, Weiner M, Li KP, Suchindran C. Epidermolysis bullosa and the risk of life-threatening cancers: the National EB Registry experience, 1986-2006. J Am Acad Dermatol. 2009 Feb;60(2):203-11. doi: 10.1016/j.jaad.2008.09.035. Epub 2008 Nov 20. PMID: 19026465.

14. Halprin K. M. (1972). Epidermal "turnover time"--a re-examination. The British journal of dermatology, 86(1), 14–19. https://doi.org/10.1111/j.1365-2133.1972.tb01886.x

15. Remington J, Wang X, Hou Y, Zhou H, Burnett J, Muirhead T, Uitto J, Keene DR, Woodley DT, Chen M. Injection of recombinant human type VII collagen corrects the disease phenotype in a murine model of dystrophic epidermolysis bullosa. Mol Ther. 2009 Jan;17(1):26-33. doi: 10.1038/mt.2008.234. Epub 2008 Nov 18. PMID: 19018253; PMCID: PMC2834970.

16. Fine J. Epidemiology of Inherited Epidermolysis Bullosa Based on Incidence and Prevalence Estimates From the National Epidermolysis Bullosa Registry. JAMA Dermatol. 2016;152(11):1231–1238. doi:10.1001/jamadermatol.2016.2473

17. Eichstadt S, Tang JY, Solis DC, Siprashvili Z, Marinkovich MP, Whitehead N, et al. From clinical phenotype to genotypic modelling: incidence and prevalence of recessive dystrophic epidermolysis bullosa (RDEB). Clin Cosmet Investig Dermatol. 2019; 12: 933– 42.

18. Has C, Hess M, Anemüller W, Blume-Peytavi U, Emmert S, Fölster-Holst R, Frank J, Giehl K, Günther C, Hammersen J, Hillmann K, Höflein B, Hoeger PH, Hotz A, Mai TA, Oji V, Schneider H, Süßmuth K, Tantcheva-Póor I, Thielking F, Zirn B, Fischer J, Reimer-Taschenbrecker A. Epidemiology of inherited epidermolysis bullosa in Germany. J Eur Acad Dermatol Venereol. 2023 Feb;37(2):402-410. doi: 10.1111/jdv.18637. Epub 2022 Nov 1. PMID: 36196047.

19. Petrof G, Papanikolaou M, Martinez AE, Mellerio JE, McGrath JA, Bardhan A, Harper N, Heagerty A, Ogboli M, Chiswell C, Moss C. The epidemiology of epidermolysis bullosa in England and Wales: data from the national epidermolysis bullosa database. Br J Dermatol. 2022 May;186(5):843-848. doi: 10.1111/bjd.20958. Epub 2022 Mar 31. PMID: 34927719.

20. Shinkuma, S., Natsuga, K., Nishie, W., & Shimizu, H. (2010). Epidermolysis Bullosa in Japan. Dermatologic Clinics, 28(2), 431–432. doi:10.1016/j.det.2010.02.010

21. Bruckner AL, Losow M, Wisk J, Patel N, Reha A, Lagast H, Gault J, Gershkowitz J, Kopelan B, Hund M, Murrell DF. The challenges of living with and managing epidermolysis bullosa: insights from patients and caregivers. Orphanet J Rare Dis. 2020 Jan 3;15(1):1. doi: 10.1186/s13023-019-1279-y. PMID: 31900176; PMCID: PMC6942340.

22. Siprashvili Z, Nguyen NT, Gorell ES, Loutit K, Khuu P, Furukawa LK, Lorenz HP, Leung TH, Keene DR, Rieger KE, Khavari P, Lane AT, Tang JY, Marinkovich MP. Safety and Wound Outcomes Following Genetically Corrected Autologous Epidermal Grafts in Patients With Recessive Dystrophic Epidermolysis Bullosa. JAMA. 2016 Nov 1;316(17):1808-1817. doi: 10.1001/jama.2016.15588. PMID: 27802546.

23. Eng VA, Solis DC, Gorell ES, Choi S, Nazaroff J, Li S, de Souza MP, Murrell DF, Marinkovich MP, Tang JY. Patient-reported outcomes and quality of life in recessive dystrophic epidermolysis bullosa: A global cross-sectional survey. J Am Acad Dermatol. 2021 Nov;85(5):1161-1167. doi: 10.1016/j.jaad.2020.03.028. Epub 2020 Mar 19. PMID: 32199895.

24. Eichstadt S, Barriga M, Ponakala A, Teng C, Nguyen NT, Siprashvili Z, Nazaroff J, Gorell ES, Chiou AS, Taylor L, Khuu P, Keene DR, Rieger K, Khosla RK, Furukawa LK, Lorenz HP, Marinkovich MP, Tang JY. Phase 1/2a clinical trial of gene-corrected autologous cell therapy for recessive dystrophic epidermolysis bullosa. JCI Insight. 2019 Oct 3;4(19):e130554. doi: 10.1172/jci.insight.130554. PMID: 31578311; PMCID: PMC6795403.

25. Robertson SJ, Orrin E, Lakhan MK, O'Sullivan G, Felton J, Robson A, Greenblatt DT, Bernardis C, McGrath JA, Martinez AE, Mellerio JE. Cutaneous Squamous Cell Carcinoma in Epidermolysis Bullosa: a 28-year Retrospective Study. Acta Derm Venereol. 2021 Aug 24;101(8):adv00523. doi: 10.2340/00015555-3875. PMID: 34230977; PMCID: PMC9413672.

26. Intong LRA, Choi SD, Shipman A, Kho YC, Hwang SJE, Rhodes LM, Walton JR, Chapman MG, Murrell DF. Retrospective evidence on outcomes and experiences of pregnancy and childbirth in epidermolysis bullosa in Australia and New Zealand. Int J Womens Dermatol. 2017 Feb 16;3(1 Suppl):S1-S5. doi: 10.1016/j.ijwd.2017.02.002. PMID: 28492031; PMCID: PMC5418959.

27. Shinkuma S. Dystrophic epidermolysis bullosa: a review. Clin Cosmet Investig Dermatol. 2015 May 26;8:275-84. doi: 10.2147/CCID.S54681. PMID: 26064063; PMCID: PMC4451851.

28. Varki R, Sadowski S, Pfendner E, Uitto J. Epidermolysis bullosa. I. Molecular genetics of the junctional and hemidesmosomal variants. J Med Genet. 2006 Aug;43(8):641-52. doi: 10.1136/jmg.2005.039685. Epub 2006 Feb 10. PMID: 16473856; PMCID: PMC2564586.

If you liked this article and want to get notified when updates are available, please consider subscribing (it's free, and you can unsubscribe at any time).

Want to support the website? Share this article on X or click here to donate. Thanks for supporting!

Tweet